Suspicious Super Bowl Halftime Prediction Trades Raise Insider Trading Concerns

Unusual Super Bowl halftime show trades on Polymarket have raised questions about insider information and oversight in prediction markets.

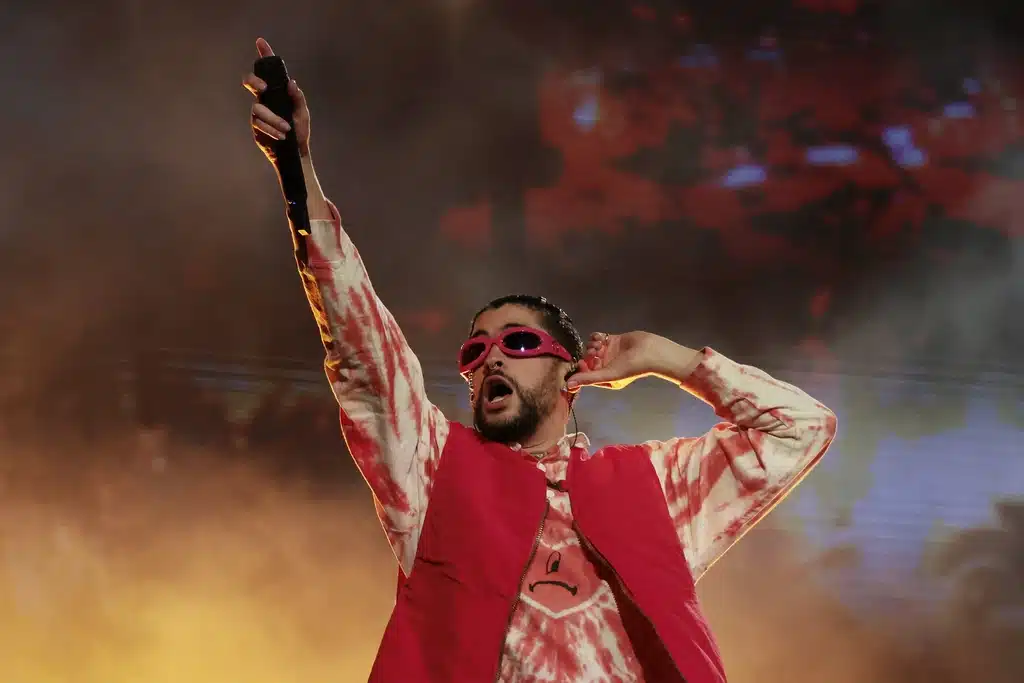

Unusual trading activity tied to Super Bowl halftime show predictions has sparked renewed concerns about insider trading and market integrity in prediction markets, following a Polymarket user who correctly anticipated multiple celebrity appearances before they were publicly confirmed.

The activity, first flagged by independent analysts and blockchain observers, involved trades that predicted appearances by Lady Gaga and Ricky Martin during the Super Bowl halftime show, outcomes that later closely aligned with verified event details.

The timing and accuracy of the trades have prompted questions about whether non-public information was used to gain an advantage.

Update: he was an insider and won all of his bets lolhttps://t.co/C6b0sWNbAl https://t.co/QFCixcKTx5 pic.twitter.com/Pj9ATTVgfH

— haeju.eth (@JeongHaeju) February 9, 2026

What the Trading Activity Shows

According to transaction data reviewed by analysts, a single trader placed sizable positions on specific halftime show appearance contracts well before confirmation or credible leaks emerged publicly.

Key elements raising concern include:

- Early entry into low-probability contracts

- Concentrated positions tied to specific performers

- Rapid price movement following the trades

- Eventual confirmation of the predicted outcomes

Observers noted that the trader’s positions appeared unusually confident compared with broader market sentiment at the time.

Why Halftime Show Markets Are Sensitive

Prediction markets tied to entertainment events are particularly vulnerable to insider information because:

- Event details are often finalized internally well in advance

- Information is shared among limited production teams

- Confirmation may lag public speculation by weeks

Unlike political or economic data, entertainment outcomes can be influenced by a relatively small number of insiders, increasing the risk that confidential information leaks into markets.

Polymarket and Market Oversight Questions

The activity occurred on Polymarket, a decentralized prediction platform that operates outside traditional U.S. financial exchange regulation.

While Polymarket has internal rules prohibiting market manipulation and insider trading, critics argue that:

- Enforcement mechanisms are limited

- Identity verification is minimal

- Surveillance tools lag behind regulated exchanges

The platform has not publicly identified the trader or disclosed whether an internal investigation is underway.

Broader Implications for Prediction Markets

The incident has intensified scrutiny around how prediction markets monitor and police insider activity — particularly during high-profile events like the Super Bowl, which draw significant attention and liquidity.

Key concerns raised by analysts include:

- Whether current surveillance tools are sufficient

- How platforms define and detect insider information

- The absence of standardized enforcement frameworks

The case has also fueled comparisons between regulated exchanges and decentralized platforms, especially as prediction markets attract more mainstream users.

Regulatory Context Adds Pressure

The episode comes as prediction markets face heightened regulatory attention in the U.S., with ongoing debate over whether event contracts should fall under gambling law, financial regulation, or a hybrid framework.

Regulators have repeatedly emphasized that:

- Markets must prevent unfair informational advantages

- Insider trading undermines public trust

- Consumer protections must scale with accessibility

High-visibility incidents tied to marquee events risk accelerating calls for stricter oversight.

Why the Super Bowl Magnifies the Issue

The Super Bowl is one of the most heavily bet-on events globally, and prediction markets surrounding it attract:

- Casual users

- Media attention

- Significant trading volume

Any perception that insiders can profit from confidential information threatens the credibility of event-based markets, particularly as they compete with regulated sportsbooks that operate under strict integrity rules.

What Happens Next

It remains unclear whether:

- Polymarket will take enforcement action

- Platform rules were technically violated

- Regulators will respond to the activity

However, the visibility of the trades has already reignited industry debate about whether prediction markets can self-police effectively as they scale.

Bottom Line

The Super Bowl halftime show trades have become a flashpoint for broader concerns about insider trading in prediction markets.

Whether or not wrongdoing is ultimately proven, the episode underscores a core challenge for the sector: as prediction markets grow more popular, maintaining trust and transparency becomes harder, and more important.

Tags/Keywords

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.