Sporttrade Moves Toward Nationwide Launch With CFTC Registration Push

Sporttrade has submitted applications to the CFTC, advancing plans to operate a federally regulated sports betting exchange nationwide.

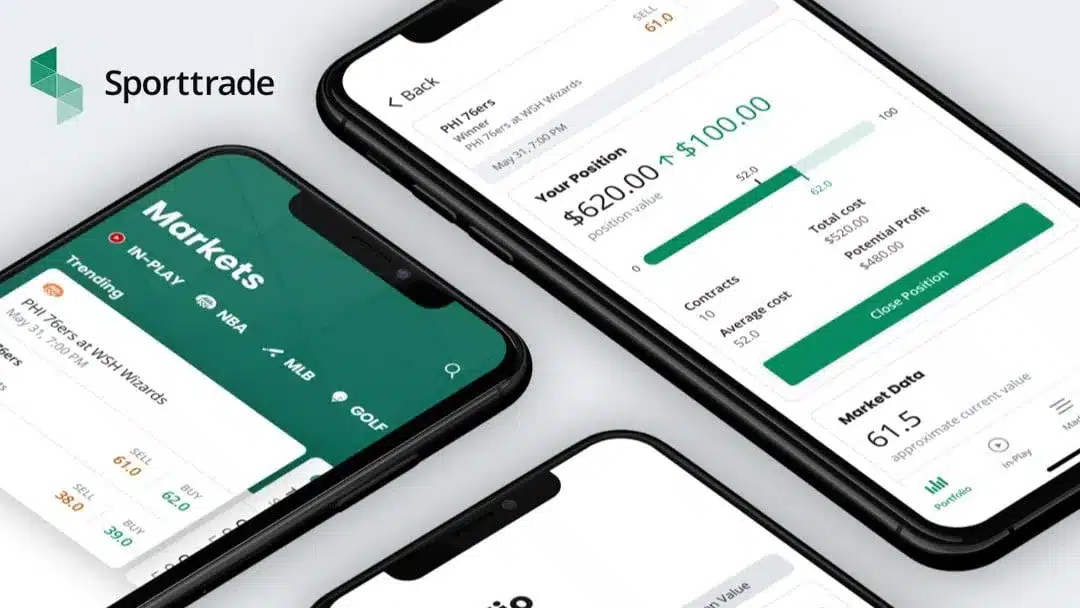

Sports betting exchange Sporttrade has taken a major step toward a nationwide rollout, submitting applications to register as both a Designated Contract Market (DCM) and a Derivatives Clearing Organization (DCO) with the Commodity Futures Trading Commission.

The move, announced via press release and confirmed by industry reporting, positions Sporttrade to operate as a federally regulated exchange and clearinghouse, a structure that would allow the company to offer sports wagering products across the U.S. under a single federal framework, rather than navigating a patchwork of state-by-state gaming licenses.

If approved, Sporttrade would become the first platform to operate sports betting in the U.S. under the same regulatory regime that governs futures, options, and other derivatives markets. Sporttrade has been working for well over a year now to improve betting markets to make this a reality.

What Sporttrade Is Seeking From the CFTC

Sporttrade has formally applied for two key registrations:

- Designated Contract Market (DCM):

Allows the company to operate a regulated exchange where users can trade contracts. - Derivatives Clearing Organization (DCO):

Enables Sporttrade to clear and settle trades, manage counterparty risk, and ensure market integrity.

Together, the registrations would allow Sporttrade to run a fully vertically integrated exchange, overseeing trading, clearing, and settlement at the federal level.

The company says this structure is designed to deliver greater transparency, tighter spreads, and improved consumer protections compared with traditional sportsbook models.

How Sporttrade’s Model Differs From Sportsbooks

Unlike traditional sportsbooks, which act as the counterparty to wagers, Sporttrade operates an exchange model, similar to financial markets.

Key differences include:

- Users trade against each other, not the house

- Prices are set by market supply and demand

- The platform earns fees rather than holding risk

- Greater price transparency and liquidity discovery

Supporters of the model argue it creates a more efficient market, reduces conflicts of interest, and aligns more closely with regulated financial exchanges.

Sporttrade has already launched in a limited number of states under traditional gaming licenses, but federal registration would dramatically expand its reach.

Why Federal Registration Matters

Currently, U.S. sports betting is regulated almost entirely at the state level, with operators required to secure licenses in each jurisdiction.

Sporttrade’s CFTC strategy seeks to:

- Replace state-by-state licensing with federal oversight

- Standardize rules across all U.S. markets

- Lower compliance friction for expansion

- Position sports betting as a financial market activity

If successful, the move could reshape how sports wagering is regulated and who regulates it.

Timing Aligns With Shifting Federal Policy

Sporttrade’s application comes at a moment of regulatory transition.

Earlier this year, the CFTC withdrew its proposed event contracts rule and a related advisory on sports contracts, signaling a more open and innovation-friendly posture toward event-based derivatives.

That shift has emboldened companies exploring federally regulated models for sports-related contracts, even as state gaming regulators continue to push back against platforms they view as offering unlicensed wagering.

Sporttrade’s approach differs from prediction market platforms in that it is seeking full exchange and clearing registration, rather than operating under no-action relief or limited approvals.

State Regulators Still Watching Closely

Despite the federal push, state gaming regulators remain skeptical of any model that bypasses traditional gaming licensure.

Several states have recently taken enforcement action against platforms offering sports event contracts without state approval, arguing that:

- Sports outcomes constitute gambling, not derivatives

- State law governs wagering within state borders

- Federal oversight does not preempt gaming statutes

Sporttrade has emphasized that it intends to operate transparently and within the bounds of federal law, but the tension between federal and state authority remains unresolved.

What Approval Would Mean for the Industry

If the CFTC approves Sporttrade’s applications, the implications could be significant.

Potential industry impacts include:

- A new federally regulated sports betting pathway

- Increased competition for traditional sportsbooks

- Pressure on state-based licensing models

- Greater convergence between finance and betting

The move could also open the door for institutional participation and new forms of liquidity in sports markets, similar to futures and options trading.

What Happens Next

CFTC review of DCM and DCO applications is a rigorous process that can take months and involves:

- Detailed risk and compliance assessments

- Public interest and market integrity analysis

- Technology and surveillance reviews

There is no guarantee of approval, and the Commission has not indicated a timeline.

Still, Sporttrade’s submission alone marks a meaningful escalation in the debate over how sports betting should be regulated in the U.S.

The Bigger Picture

Sporttrade’s push reflects a broader shift at the intersection of gambling, financial markets, and regulation.

As sports betting matures and digital platforms evolve, companies are increasingly testing whether wagering can be regulated more like a market, and less like a casino product.

Whether regulators agree may define the next phase of the U.S. sports betting industry.

For now, Sporttrade has moved the conversation forward, and put federal regulators squarely at the center of it.

Tags/Keywords

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.