Aristocrat posts 13% increase in revenue to $4.1bn

Aristocrat has published its year-end report and financial results for 2023, with revenue increasing year-over-year by 13% to $4.1bn.

This increase was chiefly owed to the growth of Aristocrat’s gaming outright sales, as well as the continued expansion of its Class III Premium Gaming Operations footprint.

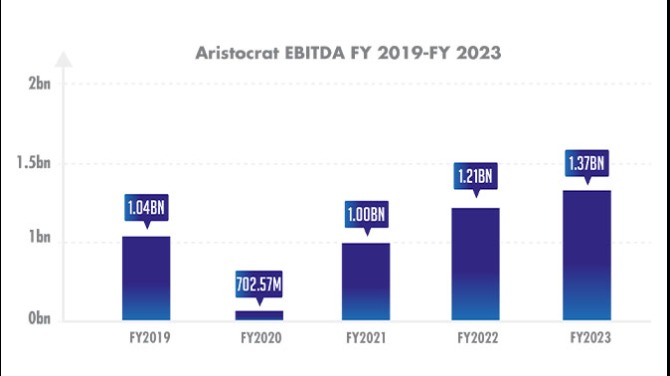

EBITDA continued its growth since the Covid-19 pandemic, as demonstrated in the graph, posting a year-over-year increase to $1.37bn for the financial year 2023.

There was year-over-year growth in NPATA (net profit after tax) as well, increasing to $863.9m, representing an increase of 21%.

It was also mentioned in the report, that AUS$443m (US$288.48m) in surplus cash was returned to shareholders in the form of on-market share buy-backs over the 12 months to 30 September 2023.

Aristocrat CEO and Managing Director, Trevor Croker, said: “The growth that Aristocrat delivered over the period demonstrates the ongoing resilience, competitiveness and diversification of our portfolio, and sound fundamentals in the markets in which we operate. At the same time, we have been able to accelerate investment behind our successful growth strategy.

“Looking ahead, we will continue to navigate challenges with a focus on portfolio performance and capturing the significant strategic opportunities in front of us, including delivering on our online RMG strategy with the proposed acquisition of NeoGames to close in the first half of calendar 2024.”

Aristocrat saw its growth in North America supported by “superior hardware configurations and high-performing game titles,” while two of the company’s businesses, Pixel United and Anaxi, also saw continued growth, despite what is described as a mixed environment for Pixel United.

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.