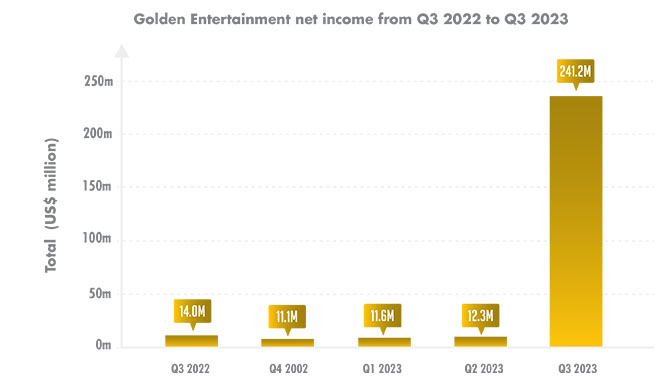

Golden Entertainment posts increase in Q3 net income to $241.2m

Company Chairman and CEO commented on improved performance in their Nevada Casino Resorts segment.

Golden Entertainment has released its Q3 financial report, posting $241.2m in net income, compared to the third quarter of 2022, which was valued at $14m, representing a ‘stratospheric’ increase of around 1622.6%.

However, revenue and adjusted EBITDA did see decreases year-on-year. Revenue was down to $257.7m from $279m for the third quarter of 2022, with Adjusted EBITIDA valued at $53.2m, compared to Adjusted EBITIDA of $61.1m for the third quarter of 2022.

Chairman and CEO Blake Sartini, gave his thoughts on the results, “For our third quarter, we saw improved performance in our Nevada Casino Resorts segment which was primarily driven by increased occupancy and our recent completion of room and pool renovations at The STRAT.”

The report does mention that the declines in revenues and Adjusted EBITIDA were down to the exclusion of full quarter results for the Company’s Rocky Gap Casino Resort and the Montana distributed gaming business, which were sold during the third quarter.

It also underlines that the 2023 third quarter results only included 24 days of operations for the Rocky Gap Casino Resort and did not include 18 days of operations for distributed gaming operations in Montana, when compared to the year prior.

Earnings for the quarter also include the impact of the $305.8m gain on the sales of the Rocky Gap Casino Resort and the Montana distributed gaming business, as well as transaction costs of $8.6m, which were recognized during the quarter.

The company also posted total principal amount of debt outstanding was $738.7m as of September 30 2023.

Sartini added, “Our Nevada Local Casinos segment maintained the strong performance we have seen throughout the year, while our taverns experienced typical seasonality with lower summer volumes. Following our divestiture of Rocky Gap Casino Resort in July, we completed the sale of our Montana distributed gaming business in September and we remain on track to complete the sale of our Nevada distributed gaming business at the end of the year.

“The completion of these transactions significantly strengthens our balance sheet, enables return of capital to shareholders and provides financial flexibility to enhance shareholder value.”

Tags/Keywords

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.