Boyd Gaming Q3 revenue up 3% to $903.2m

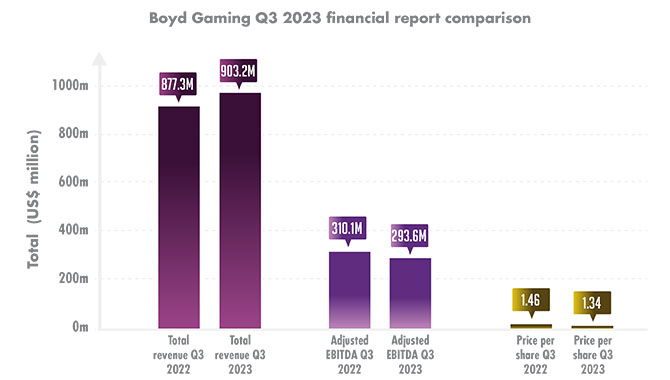

Despite share prices and adjusted EBITDA being down compared to Q3 2022, Boyd Gaming has seen an increase in total revenue.

In comparison to this time last year, Boyd Gaming has seen a minor overall revenue increase; however, it saw decreases in earnings per share and adjusted EBITDA amid other reported margins.

From the start of this year, this reflects an overall pattern of minor growth from this time last year. Nine-month revenue in 2023 has seen an increase of $151.6m compared to the nine-month revenue reported in 2022 – an increase of roughly 6%.

Boyd Gaming’s total revenue, consisting of gaming, rooms, online play and other activities totaled $903.2m in Q3 2023, a rise just shy of 3% from the $877.3m total revenue reported this time last year. Adjusted EBITDA puts this total at $293.6m; a 5% decrease from the $310.1m adjusted EBITDA reported this time last year.

The reported net income of Boyd Gaming for this quarter was $135.2m, down from $157.0m this time last year for a decrease of 14%.

Boyd Gaming reported its Q3 2023 earnings per share to be $1.34, down $0.12 from this time last year. This is notable as during this quarter Boyd Gaming repurchased $106m in shares, done as part of its ongoing share repurchase program.

While Boyd Gaming was able to report growth in its overall revenue, the increase is small when compared to others on the market. Las Vegas Sands, for example, saw its Q3 2023 total revenue increase over 50% from Q3 2022, jumping from $1.0bn to $2.8bn.

However, this increase does put Boyd Gaming ahead of other operators who have reported a loss in total revenue from Q3 this time last year, with 888 Holding reporting a 10% decrease in total revenue from this time last year.

Boyd Gaming’s market capitalisation currently sits at $6.1bn as of October 25, 2023.

In the past quarter, notable developments from Boyd Gaming have included the opening of the Boyd Innovation Lab in collaboration with the University of Nevada, Las Vegas (UNLV), designed to give students the opportunity to work in tech, products, and business to encourage the area’s economic development.

Also, as mentioned, Boyd Gaming has been working on repurchasing shares this quarter, which may in part explain the decreased value of the company’s share prices.

Tags/Keywords

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.