MGM Resorts and Rush Street Interactive post Q2 revenue growth

CEOs of both companies have commented on the potential for increased profitability and look forward to the second half of 2023.

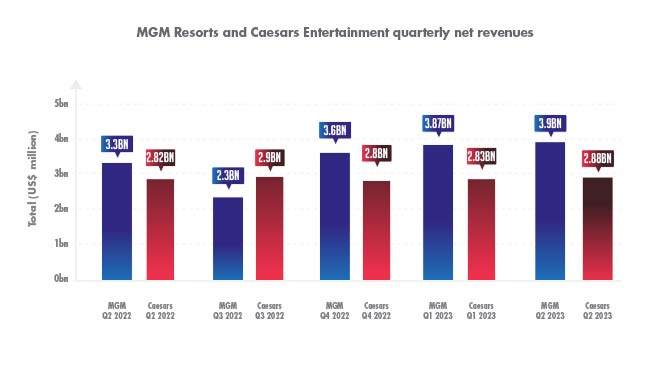

MGM Resorts International (MGM) and Rush Street Interactive (RSI) have both released their Q2 financial reports, showing a growth in revenue of 21% and 15%, respectively. Consolidated net revenue for MGM reached $3.9bn, while RSI’s revenue was $165.1m.

Bill Hornbuckle, CEO and President of MGM, said, “Beyond MGM’s outstanding second quarter performance, we also cemented a long-term agreement with Marriott which will provide us with an expansive customer booking channel. BetMGM reported that it achieved its first positive EBITDA quarter and remains on track to achieve its next milestone of second-half profitability.”

MGM also recently announced that the Cosmopolitan of Las Vegas will begin using the MGM Rewards loyalty program from February 2024.

MGM’s consolidated adjusted EBITDAR for the quarter was $1.1bn, with an adjusted property EBITDAR of $777m in Las Vegas. Net income reached $243.5m this quarter, but this was a significant decrease from $1.6bn in Q2 of 2022.

When comparing MGM to another operator of its scale, which also released its Q2 results earlier this week, the results are slightly more in line. MGM has managed to grow its net revenue rather steadily (save for a dip in Q3 of 2022), while Caesars Entertainment’s revenue has plateaued around the $2.8bn mark (save for a spike in Q3 of 2022).

RSI & digital operators

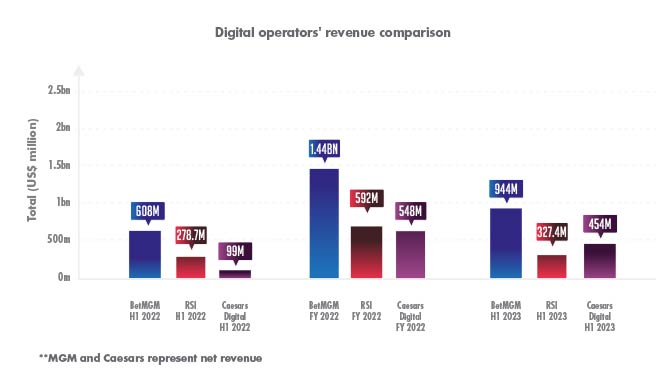

The progress for digital operators like RSI, including MGM’s and Caesars’ online gaming divisions, looks a bit less predictable. RSI’s H1 revenue for 2023 increased 17.5% year-on-year to $327.4m, which already represents over half of its FY2022 figure, $592m.

BetMGM also increased its H1 revenue year-on-year from $608m to $944m, around 65% of its FY 2022 total revenue of $1.44bn. Caesars Digital, however, experienced the largest rise from $99m in the first half of 2022 to $454m in H1 this year.

RSI posted a net loss of $16.7m for Q2 this year, down from 2022’s second-quarter loss of $28.3m. Adjusted EBITDA was also positive at $1.2m, up from a loss of $18.6m year-on-year.

Richard Schwartz, CEO of RSI, said, “Through the first half of the year the organization performed exceptionally well, achieving positive adjusted EBITDA ahead of schedule.

“This increase in profitability was mainly driven by operational improvements, as well as 15% revenue growth, led by strong growth in Colombia and markets that we launched after 2020.”

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.