IGT posts 3% increase in Q2 revenue to $1.06bn

International Game Technology (IGT) has released its Q2 financial report, showing an increase in both revenue and operating income by 3% and 10%, respectively, to reach $1.06bn and $251m. IGT also posted $1.06m in Q1 revenue this year.

Global Gaming revenue increased 13% to $373m, with higher average selling prices around the world, strong system sales, growth in installations across geographical segments and augmented unit shipments to the US and Canada. The operating income margin has also risen 150 basis points.

In the US, IGT launched its first Wheel of Fortune game, for which it has obtained a 10-year licensing extension with Sony Pictures Television. Other quarter highlights saw IGT receive a 20-year license to operate as part of a consortium in Brazil; a 10-year lottery contract in Malta and an 8-year iLottery contract in Connecticut.

Vince Sadusky, IGT CEO, said, “Our second-quarter and first-half results reflect solid revenue and profit momentum across all business segments. We achieved the high end of our outlook by executing key strategic initiatives and growing demand for IGT’s compelling content and solutions.”

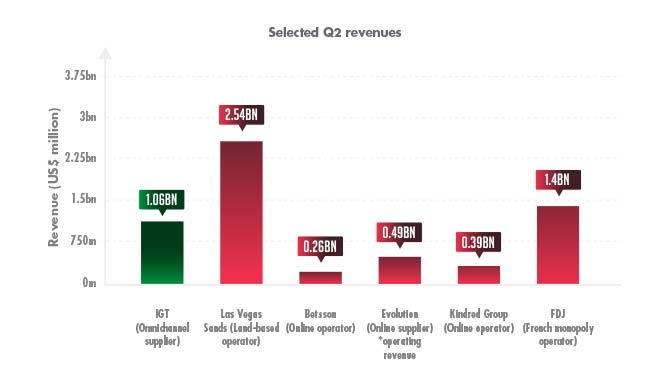

When compared to other quarterly results, IGT has risen above several other well-known companies’ Q2 revenues (the below is a selection of companies from around the industry, for comparison, rather than direct rivals).

IGT’s PlayDigital increased its revenue as well this quarter, with a 38% rise to $59m. In early June, the company announced a strategic review, which involved both the PlayDigtial and Global Gaming segments, and could potentially lead to a sale, merger or spin-off in future.

Adjusted EBITDA for Q2 2023 was $443m, up from $409m the prior year’s second quarter. The adjusted EBITDA margin increased from 40% to 42% as a result.

IGT’s Q3 expectations show a prediction of $1.0bn and an operating income margin of 22% – 23%. For FY2023, IGT has posted the goal of $4.2bn – $4.3bn with an operating income margin of around 23% as well.

The company’s current net debt of $5.4bn has risen slightly since the amount posted in December 2022, $5.2bn. As of June 30, total liquidity sits at $1.8bn.

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.