PointsBet Q4 FY23 Results: Total net win up 26%

Total full-year net win from US operations was also up 72% year-on-year.

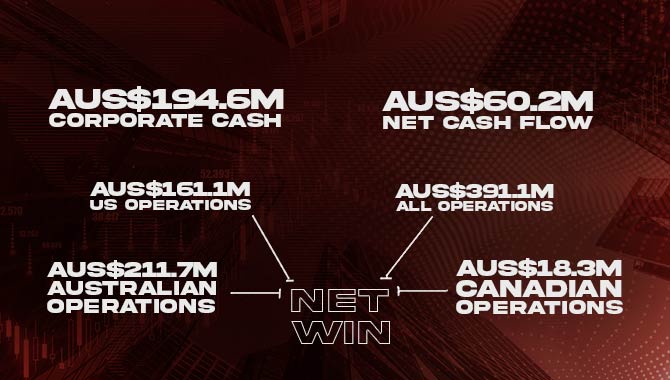

PointsBet has posted its Q4 and FY23 results, presenting net win of AU$391m (US$260.1m) for the full year overall, up 26% year-on-year.

PointsBet recently sold its US operations to Fanatics for US$225m in a bidding war against DraftKings and the report reflects a strong growth of its US operations.

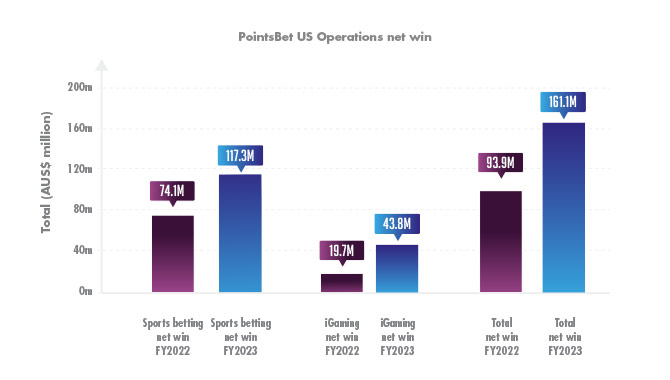

Total net win reported from US operations in FY23 was AU$161.1m, up 72% from FY22. As reflected in the graph below, both sports betting net win, iGaming net win and total net win all increased. Sports betting net win went up 58% in FY23, iGaming net win increased by 122% and the total net win went up by 72% year on year.

The graph reflects an increase overall in the US operations in FY23.

Its Canadian operations displayed a gigantic percentage growth of 10,415% during FY23; however, this was due to its Canadian operations being very new and, therefore any income the company would have generated would have been a huge jump. Q4 2022 showed that Canadian operations had only made AU$0.2m, though Q4 2023 generated AU$5.5m.

As expected, the Australian operations dominated the quarterly results. The Australian operations garnered total net win of AU$211.7m in FY2023 and generated net win of $55.6m in Q4 FY23, a 1% increase on Q4 FY22, showing a plateau in growth.

Highlights of the report.

Net cash flow is in the negative but has shown to have improved from Q3 FY23, increasing from minus AU$88.7m to minus AU$60.2m in Q4 FY23.

However, corporate cash flow decreased. Q3 FY23 showed that corporate cash flow was at AU$251.7m; it decreased to AU$194.6m in Q4 FY23. This decrease in cash flow could be a factor in the acquisition of its US operations, but it will inevitably rise once it has sold the business.

The share price for PointsBet is currently AU$1.69, which is almost half of what it was last year. Last year’s share price in July 2022 was AU$3.58.

Despite not showing its current EBITDA for this quarter, the report also states that, “as a result of the US business sale, the company expects EBITDA to be at or close to breakeven from April 2024.”

Tags/Keywords

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.