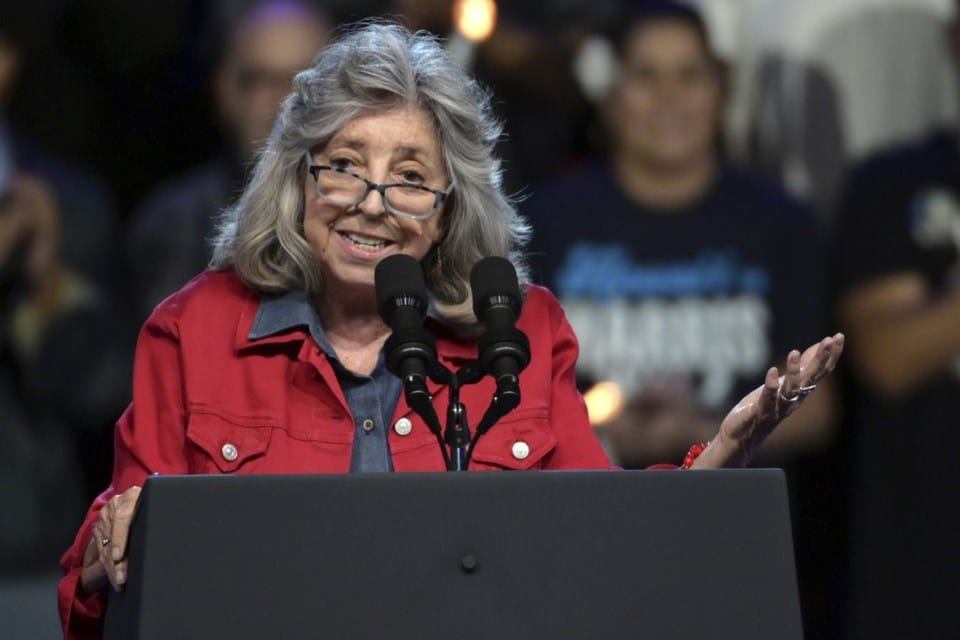

Rep. Dina Titus Files Petition to Force Vote on Gambling Tax Bill

Rep. Dina Titus launched a discharge petition to force a House vote restoring the full gambling loss tax deduction.

Nevada Rep. Dina Titus has filed a discharge petition in the U.S. House of Representatives to force a vote on legislation that would restore the full federal tax deduction for gambling losses.

The move escalates her effort to reverse a controversial provision enacted last year that reduced the allowable gambling loss deduction from 100% to 90%, creating what critics call “phantom income” taxation for bettors.

Titus has spent months working on the Fair Bet Act as an amendment to President Trump’s One Big Beautiful, which was passed in 2025.

My FAIR BET Act has been sitting in @WaysMeansCmte for eight months, despite commitments from @HouseGOP to restore the full gambling loss deduction.

— Dina Titus (@repdinatitus) February 12, 2026

I am now filing a discharge petition to bring it to the House floor for a vote.

Both high-stakes and hobby gamblers are…

What the Discharge Petition Means

A discharge petition is a procedural tool that allows lawmakers to bypass House leadership and bring a bill to the floor for a vote if it gathers enough support.

To succeed, the petition must:

- Secure signatures from a majority of House members (218)

- Remain active for a required legislative period

- Overcome resistance from the Rules Committee

Titus is using the maneuver after previous attempts to advance her bill through normal committee channels were blocked.

The Core Issue: Gambling Loss Deductions

Under prior law, gamblers could deduct 100% of documented losses against winnings, ensuring they were taxed only on net gains.

However, a provision included in the One Big Beautiful Bill (OBBB), signed into law in 2025, reduced that deduction to 90%.

As of January 1, 2026:

- Gamblers may deduct only 90% of their losses

- Winnings are fully taxable

- Some taxpayers could owe taxes even if they broke even or lost money overall

Titus argues the change unfairly penalizes both recreational and professional gamblers.

Titus’ Legislative Push

Titus has previously introduced legislation aimed at restoring the full deduction, including the FAIR BET Act.

Her discharge petition signals frustration with stalled progress and a willingness to challenge House leadership directly.

In a public statement, Titus described the current tax structure as flawed and harmful to Nevada’s gaming economy.

Nevada, home to Las Vegas and a major gaming industry workforce, has a significant stake in federal gambling tax policy.

Opposition and Revenue Concerns

Republican leadership has resisted restoring the 100% deduction, citing federal revenue implications.

The 90% cap is projected to generate approximately $1.1 billion in federal revenue over several years.

Opponents argue that reversing the provision would reduce federal tax receipts and complicate budget planning.

Supporters counter that taxing phantom income undermines fairness and could discourage regulated gambling activity.

Why This Matters for the Gaming Industry

The tax deduction change has implications beyond individual gamblers.

Industry concerns include:

- Impact on high-volume professional bettors

- Potential shifts toward offshore or unregulated markets

- Broader perception of tax fairness

Gaming industry advocates argue that maintaining competitive and predictable tax treatment is essential for regulated market stability.

What Happens Next

Titus must gather 218 signatures to advance the discharge petition.

If successful:

- The bill could receive a floor vote

- Lawmakers would debate restoring the 100% deduction

- The Senate would still need to approve any change

The effort faces political headwinds but keeps the issue in national focus.

Why This Is a High-Stakes Battle

For Nevada lawmakers, gambling tax policy is both economic and symbolic.

The fight reflects broader tensions between:

- Federal revenue priorities

- State gaming economies

- Tax fairness principles

The outcome could shape how gambling income is treated under U.S. tax law for years to come.

Bottom Line

Rep. Dina Titus has filed a discharge petition to force a House vote restoring the full gambling loss tax deduction.

The move intensifies a growing battle over “phantom income” taxation and could determine whether Congress revisits one of the gaming industry’s most controversial tax changes.

Tags/Keywords

Mark Sullivan is a casino industry analyst and editor with a background rooted in both gaming operations and data-driven analysis. He brings a practical, ground-level understanding of how casinos function, across brick-and-mortar floors and digital platforms, while maintaining a sharp focus on player experience, transparency,...

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.