Missouri Reports Over $543M in First Month of Sports Wagering, But Shows Net Loss

Missouri’s first month of legal sports wagering sees more than $543M wagered, but heavy promotional play results in limited taxable revenue.

Missouri’s newly launched legal sports wagering market opened in December 2025 with a massive amount of wagering, over $543 million in total handle , but promotional activity and deductions left sportsbooks with a net loss for the month and minimal taxable revenue for the state.

According to data published by the Missouri Gaming Commission for the month ended December 31, 2025, the state’s first full reporting period shows widespread engagement by bettors, almost entirely through mobile platforms.

But heavy deductions tied to free plays and payouts resulted in negative adjusted gross revenue (AGR) statewide.

Key Figures From Missouri’s First Reporting Period

December 2025 Sports Wagering Performance (Missouri)

- Total Wagers (Handle): $543,039,131.41 (combined mobile + retail)

- Total Payouts to Bettors: $437,719,974.25

- Free Play / Promotional Credits: $125,053,008.16

- Adjusted Gross Revenue (AGR): –$20,758,443.12 (negative due to deductions)

- Taxable Revenue: No taxable revenue recorded for December due to negative AGR

Monthly Notes:

- The state’s reporting showed a negative overall AGR, meaning that after payouts and free-play deductions, sportsbooks collectively lost money in the first month of operations.

- Retail wagering accounted for only a tiny fraction of total bets, just 48,637 of 25.6 million total wagers, with mobile wagering making up roughly 99.8 % of activity.

NEW: Missouri bettors wagered $543 million in December, the state's first month with legal sports betting;

— Ryan Butler (@ButlerBets) January 30, 2026

Due to free bets and promos, the books generated a loss of nearly ($20.1) million in adjusted gross revenue

What These Numbers Mean

Missouri’s sports wagering launch has been impressive in terms of participation: more than half a billion dollars wagered is a strong start for a newly legalized market. But traditional metrics like hold and revenue lag due to several factors:

Promotional Play Drives Down Revenue

- Operators heavily used free bets and bonus credits to attract new customers.

- These promotions are deducted from revenue before tax calculation, reducing the Adjusted Gross Revenue, the basis for taxation.

Payouts Exceed Gross Winnings

- With sportsbooks paying out more in winning bets than they collected in net stakes, raw revenue figures appear weak even if bettor participation is strong.

Breakdown by Major Operators

According to the state’s revenue detail reports:

- Bet365 Mobile: Gross revenue of over $57.7 million; taxable revenue ~ $3.8 million

- DraftKings Mobile: Highest gross revenue (~ $195 million), but net loss after promotional deductions left taxable AGR negative

- FanDuel Mobile: $212.5 million gross with a negative taxable outcome due to deductions

- Penn Sports Interactive: $6.25 million gross with ~$227,600 taxable AGR

- Smaller retail books generated modest taxable AGR ranging from the low-hundreds of thousands to just over $400,000

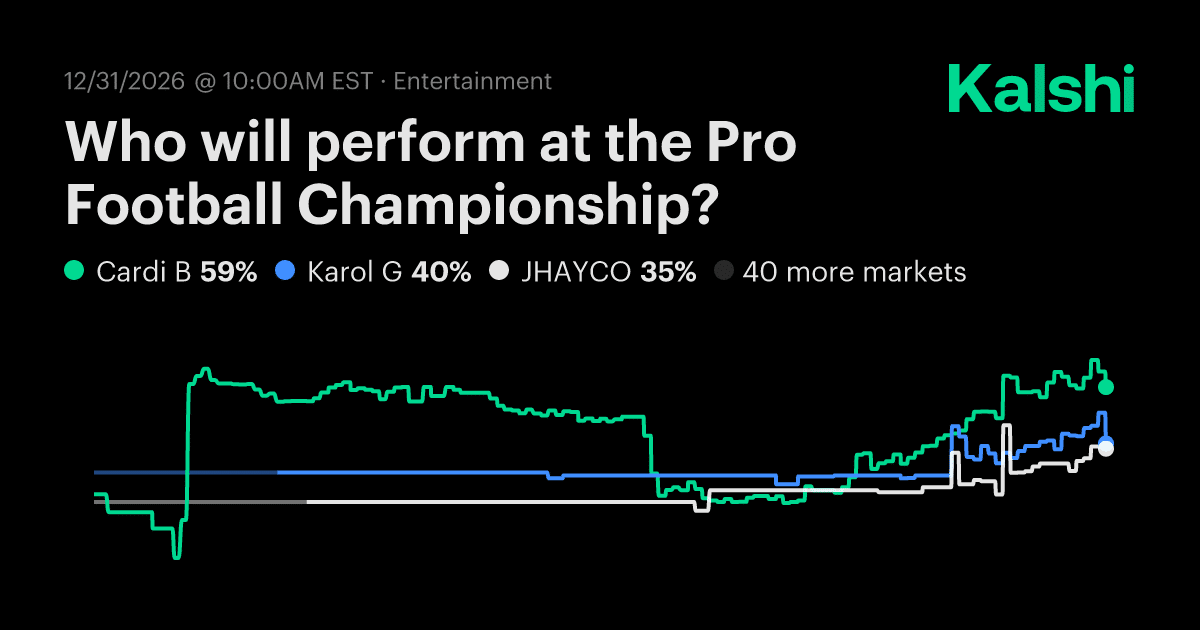

Missouri online sportsbooks by handle in December, the state's first month with legal sports betting:

— Ryan Butler (@ButlerBets) January 30, 2026

FanDuel — $212.5 m

DraftKings — $195.1 m

bet365 — $57.7 m

BetMGM — $28.1 m

Fanatics — $22.6 m

Caesars Sportsbook — $14.5 m

theScore Bet — $6.3 m

Circa Sports — $1.4 m

(Note: These figures are subject to adjustment as final reports are completed.)

How Missouri Taxes Sports Betting

Missouri levies a 10% tax on taxable gross revenue, calculated after payouts and promotional deductions. Because December’s statewide AGR was negative, no sports betting tax revenue was collected that month.

Promotional deductions, such as free play, are common in new markets and help attract users, but they also reduce the taxable base, a dynamic seen in other emerging jurisdictions.

Comparison With Other States

Missouri’s initial tax outcome mirrors early trends in other markets where heavy promotions and low holds weighed on taxable revenue.

In Colorado’s first full year, even with billions wagered, sports betting taxes were lower than projected until promotional deductions eased.

Over time, as promotional intensity tapers and bettors settle into patterns, hold and measurable revenue typically improve.

Over 250k sports betting accounts were active on Missouri’s Dec. 1 launch, per @GeoComply.

— Sam McQuillan (@sam_mcquill) December 2, 2025

That’s roughly 6.4% of the state’s 21+ population. pic.twitter.com/2gXqQunmEx

What Comes Next for Missouri

- The Missouri Gaming Commission will publish monthly reports tracking handle, revenue, hold percentage, and tax collections as the market matures through 2026.

- Early results provide a baseline for trends but are considered provisional given the market’s phased rollout and heavy launch promotions.

- Lawmakers and budget analysts will watch closely as real tax revenue begins to flow, particularly with an eye toward funding education and problem-gambling programs, as anticipated in the original legalization measure.

Quick Facts: Missouri Sports Betting Launch

- Launch Date: December 1, 2025, legally authorized after voter approval of a constitutional amendment.

- Tax Rate: 10 % on adjusted gross revenue.

- Mobile Dominance: Nearly all handle came from mobile wagering.

Tags/Keywords

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.