Galaxy Gaming Q3 2023: Adjusted EBITDA decreased by 36%

Net loss doubled compared to Q3 2022.

Galaxy Gaming has announced its financial results for the quarter and nine months ended September 30 2023.

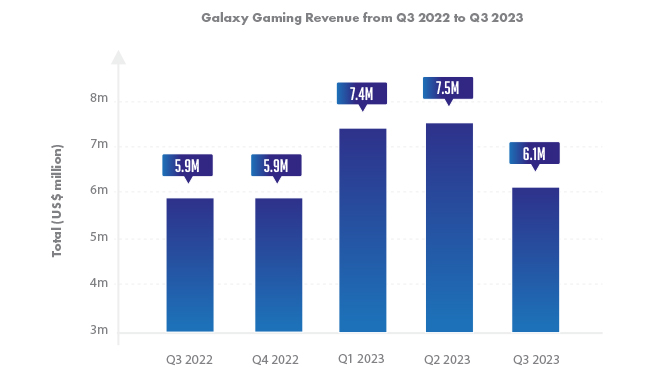

In its statement, the company reflected that year-on-year revenue rose 3% to $6.1m; adjusted EBITDA decreased by 36% to $1.5m; and net loss almost doubled, increasing from minus $699,000 to minus $1.5m.

For the nine months 2023 vs nine months 2022, Galaxy Gaming’s revenue increased 20% to $21.1m; adjusted EBITDA rose 6% to $7.8m and net loss increased from minus $988,000 to minus $1.8m.

When speaking on the successive decline in revenue since Q4 2022, Galaxy’s President and CEO, Todd Cravens, commented, “We had a sequential decline in revenue in Q3 principally because sales of perpetual licenses were lower in Q3 than in Q1 and Q2. We expect that future sales of these perpetual licenses will make our quarterly results lumpier than in the past.

“However, we will continue to pursue these sales as they result in substantial increases to our installed base and offer additional recurring revenue opportunities.”

Cravens also added insights that the company expects increased revenue in fiscal 2024. The revenue amount forecasted for next year is in the range of $7m-$7.5m and adjusted EBITDA is expected to be in the range of $2.8m-$3.2m. The forecast assumes around $200,000 in perpetual license sales and around $800,000 in net revenues from EZ Baccarat distribution.

Harry Hargerty, CFO at Galaxy Gaming, clarified the reasoning for expense increases, “Our expenses increased year-over-year due to several factors. Cost of sales and sales commissions increased by almost $200,000, largely related to the perpetual license revenue in Q3 ‘23.

“Compensation costs increased by approximately $236,000 due to headcount and salary increases which were offset by a $103,000 decrease in share-based compensation expense. Legal and regulatory expenses increased due to our continuing efforts to protect our IP worldwide and to increased jurisdictional filings in connection with our EZ Baccarat distribution agreement.”

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.