Q2 results: Is DraftKings finally turning a corner?

Key highlights

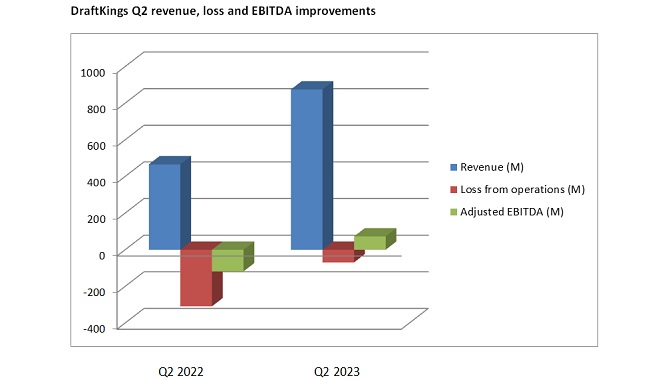

– H1 revenue almost doubled year-over-year to $1.64bn

– Q2 loss from operations heavily reduced to $69m; adjusted EBITDA reached $73m

– Monthly average revenue per bettor up 33% to $137

– CEO’s positive comments earlier this year look more justified, as revenue and EBITDA guidance is raised for 2023 and especially Q4

Gaming America has often pointed out the slow returns facing DraftKings investors – that every quarterly revenue increase seemingly came with another $200m-$300m net loss (or greater).

But not this time. With DraftKings nearing $1bn in revenue for Q2 2023, its loss from operations was just $69m for the quarter, suggesting the operator may genuinely be turning a corner – and that its initially expensive business model might, after all, be set to pay off in the long term.

Q2 and H1 breakdown

Indeed, DraftKings generated $874.9m in Q2 revenue, almost doubling year-over-year, with H1 revenue reaching $1.64bn – also almost doubling from H1 2022.

And, while the jury may still be out on the path to profitability, DraftKings’ $69m loss from operations showed an improvement of no less than $239.9m; additionally, H1’s figure ($458.8m) was almost a 100% improvement year-over-year – with the bulk of that figure being the result of Q1’s $389.8m loss.

Net loss attributable to common stockholders sat at $77.2m, another stark improvement from the $217m that came in Q2 2022, while H1’s figure totaled $474m – again down on H1 2022’s $684.8m.

Adjusted EBITDA painted an even better picture for the operator, with positive EBITDA finally achieved (at $73m). By contrast, Q2 2022’s adjusted EBITDA totaled negative $118.1m and H1 2022 saw negative adjusted EBITDA of $407.6m.

For H1 2023, adjusted EBITDA was still at a negative $148.6m due to the impact of Q1, but the overall results prompted understandable positivity from both CEO Jason Robins and CFO Jason Park – whose impact should not be underestimated since joining the operator in June 2019.

What they said

Robins commented in the Q2 report: “DraftKings produced outstanding results for the second quarter of 2023. We grew revenue at an impressive year-over-year rate, captured additional GGR (gross gaming revenue) share in a cost-effective manner and maintained our focus on operational efficiency.

“The positive adjusted EBITDA we generated in the second quarter exceeded our guidance, and we are well on our way to achieving positive adjusted EBITDA again in the fourth quarter of 2023; and for fiscal year 2024 and beyond.

“We are excited by the additional product features and functionality we are introducing leading into football season, and also look forward to another successful online sportsbook launch in Kentucky this fall pending licensure and regulatory approvals.”

Meanwhile, CFO Park added: “We are acquiring new customers efficiently while simultaneously retaining and monetizing our existing players through rapid product innovation, less promotions and higher hold from better bet mix.

“Our unit economics are outstanding with older states generating more than enough cash to fund investment in new states. This performance, combined with fixed costs that grew at only a mid-single digit year-over-year percentage rate in the second quarter, resulted in an inflection to positive adjusted EBITDA we expect will occur again in the fourth quarter and for full year 2024.

“As a result, we are increasing the midpoint of our fiscal year 2023 revenue guidance to $3.5bn from $3.185bn and improving the midpoint of our fiscal year 2023 Adjusted EBITDA guidance to ($205)m from ($315)m.

Defending the product

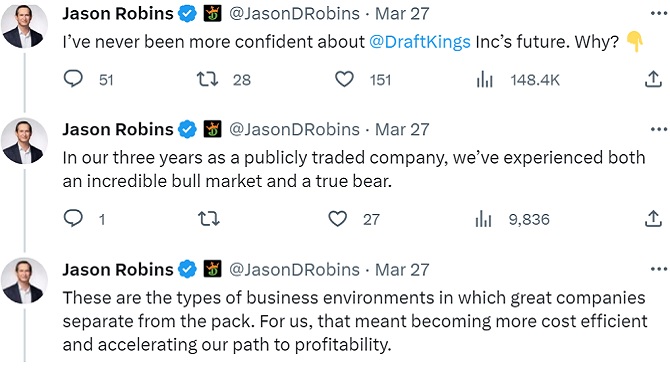

It is no wonder CEO Robins was keen to take to social media back in March to defend DraftKings’ business model. Tweeting to investors is not the most conventional move for a gaming CEO (it is perhaps more akin to the X platform’s owner Elon Musk), but Robins’ robust backing of the brand now looks better with Q2 hindsight.

DraftKings is not completely out of the woods yet, of course; it is still yet to turn a profit while its revenue is still behind that of chief rival FanDuel’s. But Q2 has definitely cut several gaps for the organization in a very positive way.

DraftKings’ share price has risen around 15% over the past month and saw a small fall on the day before the publication of its Q2 report. At the time of writing, DraftKings stock is valued at $29.99.

Keeping costs down

‘EBITDA positive’ is the trending phrase of the quarter, with BetMGM already achieving positive EBITDA for Q2 and expecting it for H2. Although FanDuel is yet to report its Q2 results (which will truly show exactly where the US online sports betting market stands), Rush Street Interactive also reported positive adjusted EBITDA for Q2; and so too did Caesars Digital.

DraftKings was keen to emphasise its “healthy growth” in customer acquisition for the quarter – but perhaps more importantly its customer retention, as the cost of keeping customers engaged comes down for the operator.

Average monthly revenue per bettor stood at $137, a 33% yearly growth – due to “improvement in the company’s structural sportsbook hold rate and reduced promotional intensity.”

Looking up

DraftKings’ quarterly performance has seen it raise full-year 2023 revenue guidance to a range of $3.46bn-3.54bn, roughly $300m higher than previous estimates. Adjusted EBITDA guidance has also gone up to between negative $190m and negative $220m – an improvement from previous estimates of negative $290m to negative $340m.

Finally, though not specifically mentioning Q3, DraftKings was very eager to emphasise its Q4 projections: nearly $1.2bn in revenue and adjusted EBITDA of $150m-$175m.

Tags/Keywords

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.