Catena Media posts 2% North American revenue drop, despite Ohio launch

Catena Media has reported revenue of €35m ($37.9m) from continuing operations for Q1 of 2023. This represents a 5% decrease in continuing operations year-on-year.

But revenue including discontinued operations, such as Gaming Innovation Group’s acquisition of AskGamblers from Catena Media for €45m in Q4 of 2022, contributed to €36.2m, a 20% decrease.

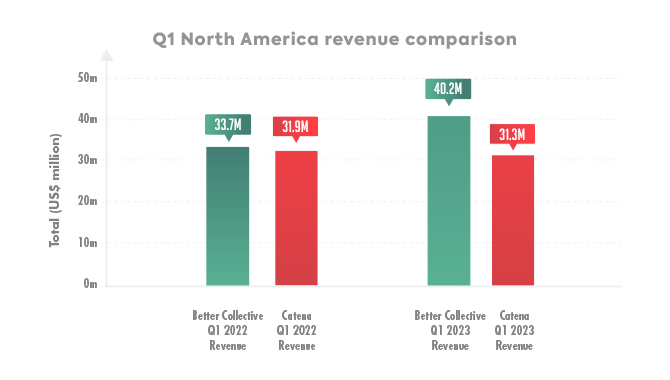

Interestingly, North American revenue also slightly dropped 2% year-on-year to €28.9m. In January, Catena announced its most successful state launch, with more transactions made during the first two days of its Ohio sports betting launch than Catena has ever experienced during any other state launch.

Figures for Catena’s existing state operations must have decreased, offsetting the success of Ohio. However, the affiliate is playing the long game in the US, as CEO Michael Daly commented, “The North American market is still relatively early in its growth cycle and process.”

By comparison, fellow affiliate Better Collective saw a 19% increase in North American revenue. Ohio and Massachusetts sports betting launches were largely responsible.

Catena’s strategic direction update also includes reference to a slower launch calendar in the US for the rest of the year, due to federal elections, but the affiliate expects “faster-paced” state launches for sports betting and online casino products in late 2024-2025.

Catena released final targets for 2023-2025, including North American revenue of €115m in 2025, which would represent an annual growth rate of 12% from 2022, as well as an adjusted EBITDA margin (across all regions) of over 50%.

Its Q1 adjusted EBITDA margin from continuing operations was 59%, down from 60% year-on-year, totalling €20.5m.

The adjusted EBITDA including discontinued operations reached €19.4m.

Earlier this month, Catena appointed Erik Edeen as its interim CFO, following the announcement of Peter Messner’s departure.

Tags/Keywords

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.