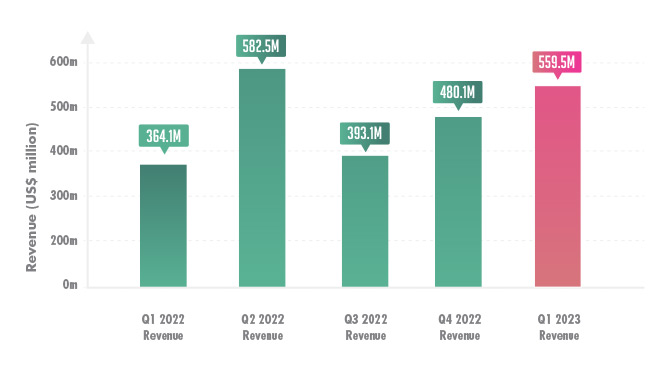

Churchill Downs gallops ahead in Q1 with $559.5m revenue

Churchill Downs (Churchill) has released its first quarter financial results. The racetrack operator, which houses the Kentucky Derby, offers a full calendar of horseracing and occasions.

Net revenue for Churchill’s first quarter was up 16.5% from the previous quarter, and up 53.6% year-over-year, reaching $559.5m. Net income also increased to $155.7m, from $42.1m in Q1 last year.

Adjusted EBITDA rose 73% to $222.9m this quarter, as all three of Churchill’s reporting segments also increased. Live and historical racing, TwinSpires and gaming were all up at least 22% when compared to Q1 of 2022, with live and historical racing experiencing the biggest jump of 194%.

Churchill’s financial report states that live and historical racing net revenue ($215.8m) increased due to the acquisition of Virginia properties, the opening of a Turfway Park in Northern Kentucky in September 2022, the acquisition of Ellis Park and Chasers Transactions, an increase from the Oak Grove property, an increase from the Derby City property and an increase from Churchill Downs Racetrack.

It has been a busy quarter for Churchill with sales, offerings and amended credit agreements.

On February 15, the company closed the sale of its Arlington Heights, IL property for $197.2m to its new owners, the NFL’s Chicago Bears. On February 24, Churchill announced an amendment of its senior secured credit agreement.

On April 25, Churchill closed an offering of $660m of 6.7% senior notes due 2031, as well as announced a two-for-one stock split of common stock and a proportionate increase in the number of authorized shares.

Tags/Keywords

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.