Golden Nugget Online Gaming to go public after $745m purchase agreement reached

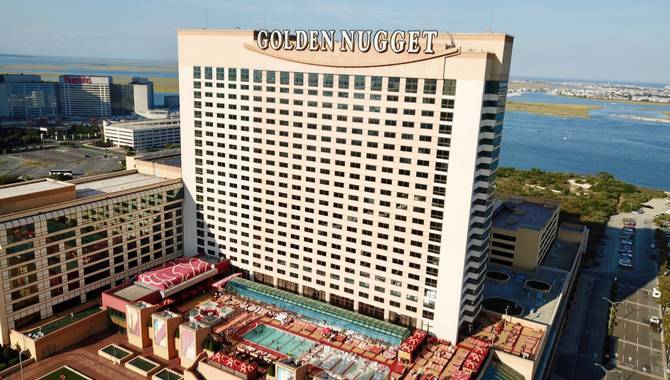

Golden Nugget owner Landry’s Incorporated has reached a purchase agreement for the sale of the online casino branch of the gaming company.

The agreement will see Landcadia Holdings II, an acquisition business, acquire Golden Nugget Online Gaming (GNOG) for a fee of approximately $745m – representing 6.1 x its projected 2021 revenue of $122m.

The amount payable in the transaction will consist of a combination of cash and rollover equity in Landcadia II.

After payment of the associated transaction fees, including debt repayment and expenses, the combined company will have at least $80m on its balance sheet at closing and an anticipated pro forma equity market capitalization of almost $700m.

Through the deal, GNOG will go public on the Nasdaq exchange, becoming only the second publicly traded exclusively online casino company in the US.

The acquisition is expected to be completed in Q3 this year and will see Landcadia II rebrand itself as Golden Nugget Online Gaming, Inc.

Tilman J. Fertitta, the current owner of GNOG, will remain chairman and CEO of the company, while Thomas Winter will continue in his role as GNOG’s president.

Rich Handler, co-chairman of Landcadia II, described GNOG as “one of the best positioned companies to capitalize on this massive online gaming opportunity in the US.”

GNOG started its operations in New Jersey in 2013 and last year generated more than $11m in net income, according to the company.

Essential Casino & Betting Guides

Looking for the best casinos or betting sites? Below you’ll find our recommended guides for 2026.

- Best Online Gambling Site

- Online Casinos

- Betting Sites

- Best Bitcoin Betting Sites in 2026

- Best Offshore Sportsbooks for US Players

- Real Money Online Casinos in Canada

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.