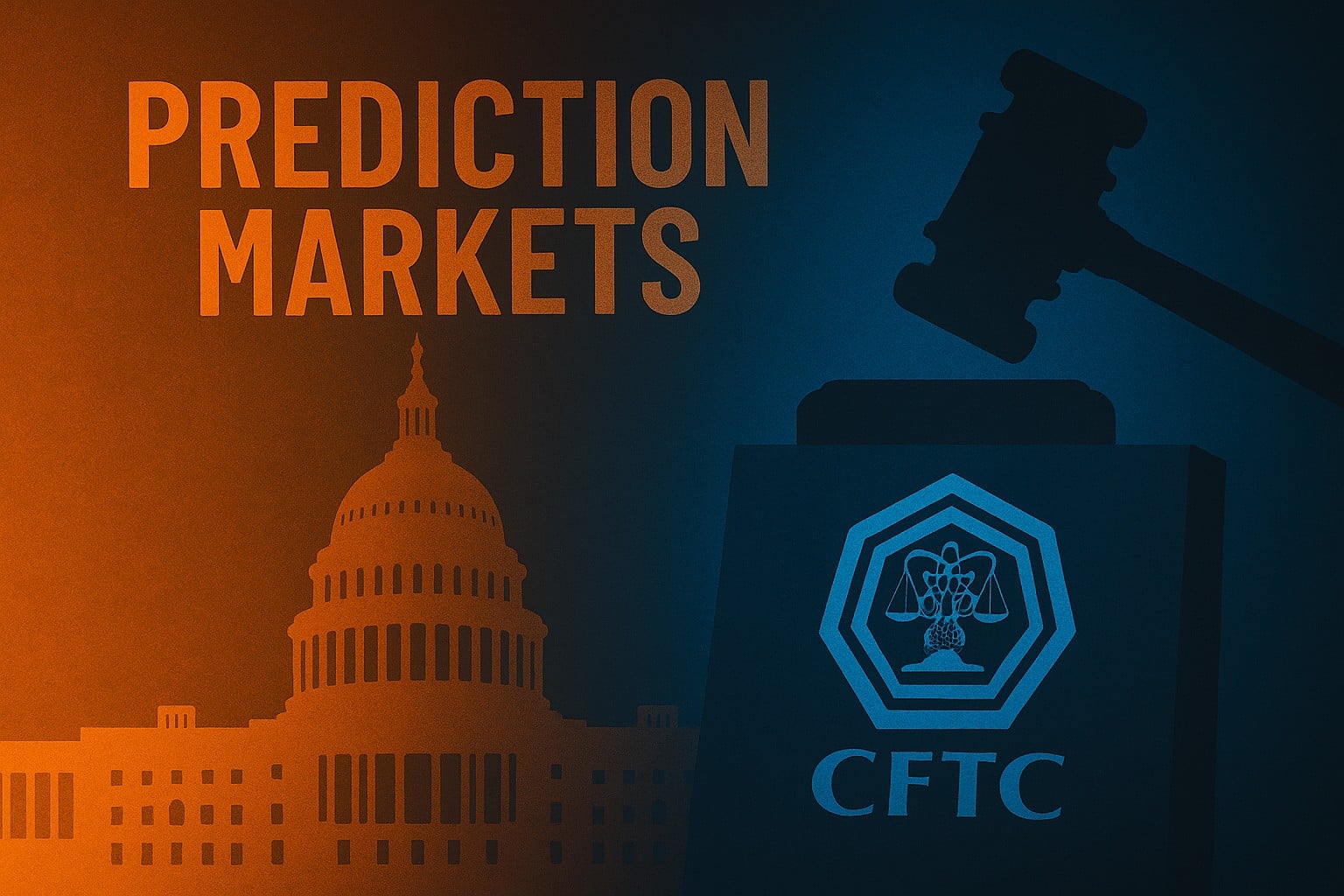

Novig applies for CFTC approval to operate as a regulated U.S. prediction market

Novig, a state-regulated sweepstakes platform, has applied to the CFTC to become a federally approved prediction market exchange as interest and competition in event contracts surge nationwide.

Novig, a prediction-market platform that originally grew out of the sweepstakes gaming sector, has taken a major step in its evolution by applying to the U.S. Commodity Futures Trading Commission (CFTC) for approval to operate as a federally regulated prediction market exchange.

The pending application, which would allow Novig to offer event contracts under the Commodity Exchange Act, marks a strategic response to rapid growth and increased regulatory focus in the prediction market space, where firms seek clarity and legitimacy amid competing legal interpretations about oversight.

A Growing Prediction Market Sector

Prediction markets, platforms where participants can trade outcomes based on future events, have expanded rapidly in the U.S. since Kalshi began offering federally regulated contracts in 2021. These markets allow users to speculate on events ranging from politics and economics to weather and sports results, and they currently fall under CFTC jurisdiction when registered and approved by the agency.

According to a recent industry report, prediction markets burst onto the American marketplace in late 2024 and have continued to expand into a wide range of categories, including crypto, climate, economic indicators, and sports.

Novig is among several platforms seeking to join the regulated fold, alongside industry players such as Kalshi, Polymarket (which relaunched in the U.S. after obtaining CFTC-approved operations), and others.

Novig previously raised $18 million as a state-regulated sweepstakes platform and has aimed to leverage that momentum to gain federal oversight from the CFTC, reflecting broader momentum for prediction markets as a distinct category of financial and event-based trading.

Why CFTC Approval Matters

Receiving CFTC approval would give Novig a formal designation, often as a Designated Contract Market (DCM) or another recognized exchange status, permitting it to list and clear event contracts that can be legally offered to U.S. traders nationwide.

CFTC-regulated markets differ from traditional state-licensed sportsbooks because they are overseen at the federal level, enabling broader access without requiring individual state gambling approvals.

The regulatory framing has been controversial: while firms like Kalshi argue that CFTC jurisdiction preempts state gaming laws for event contracts, several states, including Massachusetts, have successfully challenged prediction markets that offer sports-related contracts without local licensing.

This regulatory tension has contributed to legal battles and industry debates about whether prediction markets are derivatives under federal law or effectively unlicensed gambling in certain states. A CFTC approval for Novig would affirm the federal model and allow it to operate with greater legal certainty in this evolving landscape.

Industry Interest and Competitive Landscape

Novig’s push for approval comes amid growing institutional and mainstream interest in the prediction market model. Traditional financial firms, including heavyweights like Goldman Sachs, have publicly acknowledged the category’s potential, viewing some event contract structures as analogous to existing financial instruments.

Meanwhile, mainstream players like FanDuel have expanded their prediction market offerings, notably through FanDuel Predicts, a platform live in all 50 states with sports-event contracts in 18 jurisdictions, showing how the concept is gaining traction beyond niche, crypto-centric exchanges.

Other platforms, such as Polymarket, have also re-entered the U.S. market under CFTC oversight, further illustrating how the regulatory path can open doors for platforms willing to seek federal legitimacy rather than operate in regulatory gray zones.

What’s Next for Novig

The CFTC review process will determine whether Novig meets regulatory requirements related to market integrity, consumer protections, surveillance, recordkeeping and anti-fraud controls.

Approval could position Novig as a competitor in a space that is still consolidating amid legal challenges, technological innovations and rising institutional investment.

For participants and observers, Novig’s application underscores the momentum and contention around prediction markets, from regulatory debates and court rulings to rapid expansion across new contract types and user segments.

As the CFTC continues to clarify its approach to event contracts and market approvals, Novig’s journey may serve as a bellwether for other platforms seeking to operate under a federally regulated framework and capitalize on the growing appetite for prediction-based trading and betting alternatives.

Tags/Keywords

Mark Sullivan is a casino industry analyst and editor with a background rooted in both gaming operations and data-driven analysis. He brings a practical, ground-level understanding of how casinos function, across brick-and-mortar floors and digital platforms, while maintaining a sharp focus on player experience, transparency,...

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.