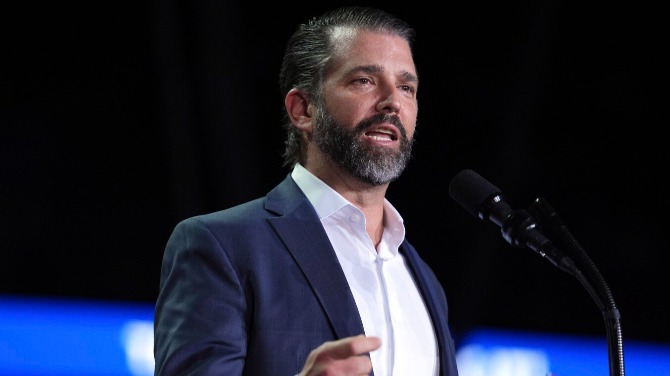

1789 Capital invests into Polymarket, Donald Trump Jr. appointed to Advisory Board

While Polymarket has not disclosed the terms of the agreement at the time of writing, reports have stated 1789 Capital’s investment was in the double-digit millions of dollars.

Key Points

- In January 2025, Trump Jr. was also appointed as Kalshi’s new Strategic Advisor, with the prediction markets platform describing the hire as an “important addition to the team”

- Polymarket was originally founded by CEO Shayne Coplan in 2020, as users have already placed $6bn worth of trades within the first half of 2025

Polymarket has received an investment from Donald Trump Jr.-backed 1789 Capital, rumored to be in the double-digit millions of dollars, as the current President of the United States’ son will also join the prediction markets platform’s Advisory Board.

“Polymarket cuts through media spin and so-called ‘expert’ opinion by letting people bet on what they actually believe will happen in the world,” Trump Jr said in a statement.

The predictions market platform has yet to disclose the terms of the investment, but this also does not represent the first time Trump Jr. has been selected to advise a company offering such wagers.

In January 2025, Trump Jr. was appointed as Kalshi’s new Strategic Advisor, with the company describing the hire as an “important addition to the team” and believed he would offer a fresh perspective as Kalshi expanded US operations.

“With his extensive business experience and influence, Don Jr. brings a fresh perspective to Kalshi as we continue to push prediction markets into the mainstream,” Kalshi said in a statement following the hire.

“This important addition to our team marks a major milestone for the future of Kalshi – and for how Americans uncover the truth in today’s fractured, often biased media landscape.”

Good to know: Following the engagement of Kansas City Chiefs tight end Travis Kelce and well-known recording artist Taylor Swift, Kalshi began offering odds on events such as whether the two will get married prior to the end of 2025

The interest in predictions market potential has also caught the eye of sports betting operators currently conducting business in the US, as FanDuel formed a new partnership with derivatives marketplace CME Group to begin the development of “fully funded, event-based contracts with defined risk.”

Expected to launch in late 2025, the products will include benchmarks such as the S&P 500 and Nasdaq-100, prices of oil and gas, gold, cryptocurrencies and key economic indicators such as GDP and CPI.

Tags/Keywords

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.