Sands Q2 net revenue up to $2.54bn – 2019 levels in sight but still a way off

Key takeaways:

- Q2 net revenue up to $2.54bn, a huge rise but still short of 2019’s Q2 total of $3.33bn

- Q2 net income from continuing operations amounted to $368m

- For H1, Sands generated $4.66bn in net revenue and $915m in operating income

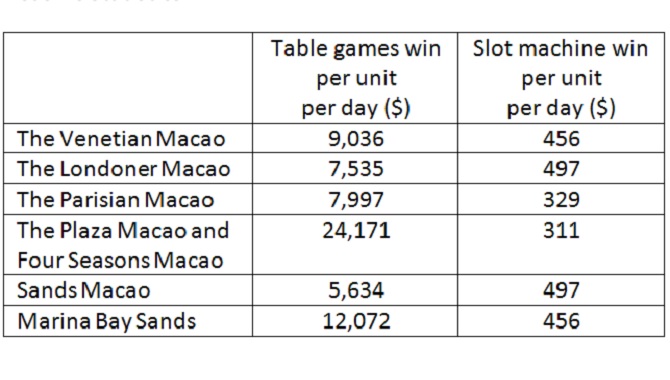

- Marina Bay Sands does heavy lifting as an individual property, but Macau operations continue to recover (Plaza and Four Seasons Macao sees most profitable table games per unit)

- Market capitalization of $45.6bn keeps Sands at forefront of the industry; with quarterly dividend now reinstated at $0.20 per common share

Industry giant Las Vegas Sands, originating in the US but currently operating some of the biggest properties in Asia, has posted Q2 net revenue of $2.54bn – a 141% increase year-on-year.

The growth continued for Sands’ other KPIs, with net income from continuing operations totaling $368m, compared to a net loss from continuing operations of $414m for the corresponding period.

Consolidated adjusted property EBITDA sat at $973m, compared to $209m for the prior-year quarter.

For H1, meanwhile, Sands generated $4.66bn in net revenue, an annual rise of nearly double; and operating income for the first six months of the year totaled $915m, compared to a $449m operating loss for the corresponding H1 period.

Marina Bay Sands showed continually improving results for the operator – again referred to as “outstanding” by CEO and Chairman Robert Goldstein – while Macau continued to show improvement; although we will explore further down in this report that Sands still has a way to go to reach 2019 levels.

At the time of writing, Sands’ share price sits at $58.90, having roughly doubled over the past year. One of the industry’s foremost operators, it sits with a market capitalization of $45.6bn. Following its Q2 results, Sands has reinstated its quarterly dividend to shareholders, at $0.20 per common share.

Q2 breakdown

Revenue

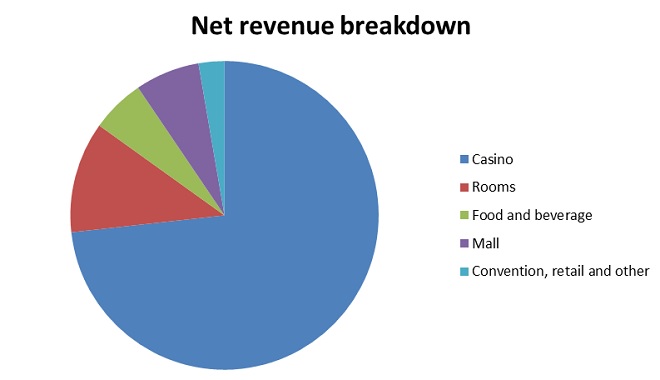

Reinforcing the gaming-first mentality of the typical Asian bettor, Sands generated $1.86bn of its $2.54bn in Q2 revenue from casino gaming alone.

By comparison, the majority of a Las Vegas resort’s revenue in today’s sector (for example, Caesars Palace, the Bellagio or the Wynn) would normally be accrued via non-gaming entertainment sources.

Rooms made Sands $296m during Q2, with food and beverage earning $143m, mall activities earning $172m and convention, retail and other accounting for $68m.

Through the years

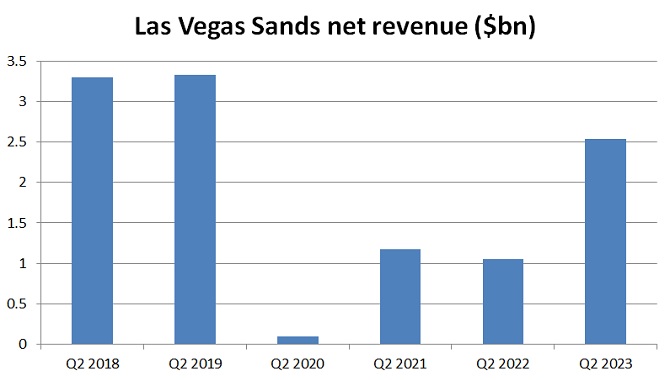

As the above graph shows, Sands is well on the way to restoring peak performance, though it has some distance left to cover to reach the highs of Q2 2018 ($3.3bn) and Q2 2019 ($3.33bn).

The Covid-19 pandemic saw net revenue fall as low as $98m for Q2 2020, before Sands generated $1.17bn for Q2 2021; a small drop followed to $1.05bn for Q2 2022.

This year’s Q2 revenue of $2.54bn represented a 141% rise for the industry giant.

Key properties

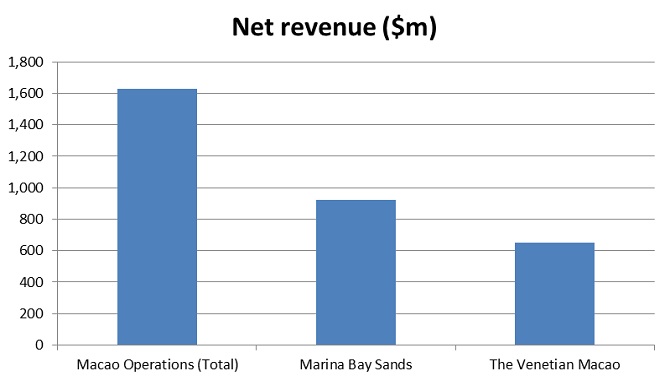

As the above chart shows, Marina Bay Sands stood very clearly as a key revenue generator for Sands. On its own, it made nearly $1bn for Q2 ($925m), with Sands’ total Macau operations accounting for $1.62bn.

The only individual Sands property that came remotely close to challenging Marina Bay Sands during Macau’s ongoing recovery was the Venetian Macao, which generated $653m in Q2 net revenue.

It was a similar story for adjusted property EBITDA across the board, with Marina Bay Sands generating $432m here, The Venetian Macao $252m and the Londoner Macao $103m.

No other Sands property reached the $100m mark in this category but The Plaza Macao and Four Seasons Macao did record a higher adjusted EBITDA than The Parisian Macao – despite making less net revenue for the quarter.

Costs

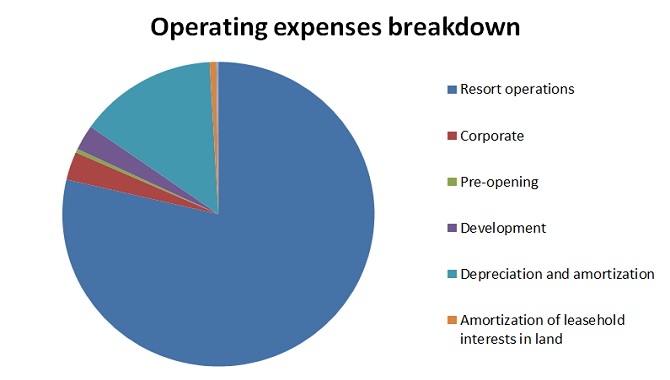

Operating expenses were, similarly, dominated by one category: resort operations ($1.57bn). Corporate costs amounted to $60m for the period, with pre-opening costs setting Sands back $8m and development costs $54m.

Depreciation and amortization cost Sands $288m for Q2, with amortization of leasehold interests in land costing $14m and loss on disposal or impairment of assets being worth $4m for the period.

All in all, this led to an operating income of $537m for Q2, a far healthier outlook for Sands than the $147m loss it made for Q2 2022.

When other costs were taken into account, net income attributable to the operator amounted to $312m – compared to a loss of $290m for Q2 2022.

Casino statistics

The casino statistics from Las Vegas Sands’ Q2 report (shown above) make for interesting reading. Firstly, they demonstrate the dominance of table games for Sands’ properties in Macau and Singapore, with slot machines winning casinos several hundred dollars a day per unit – but table games well into the thousands.

Per unit, though, Marina Bay Sands is not the leader here. Indeed, The Plaza Macao and Four Seasons Macao has far more profitable individual tables. Of course, the average number of table games at Marina Bay Sands totaled 513 for Q2, more than five times the 91 boasted by The Plaza Macao and Four Seasons Macao, making the gaming totals very different to the win per unit per day.

In anticipation of the company’s Q2 results, Gaming America recently analyzed the changing face of Las Vegas Sands.

With expectations exceeded for the quarter, though, Sands investors will be encouraged by the current changes being shown by Sands’ financials. The Covid-19 pandemic is approaching the rear-view mirror for its Macau properties, if not yet fully out of sight.

Tags/Keywords

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.