Q1 2022 results revealed for Churchill Downs Incorporated

Ending on March 31, 2022, the company saw $42.1m in net income compared to $36.1m in Q1 of 2021

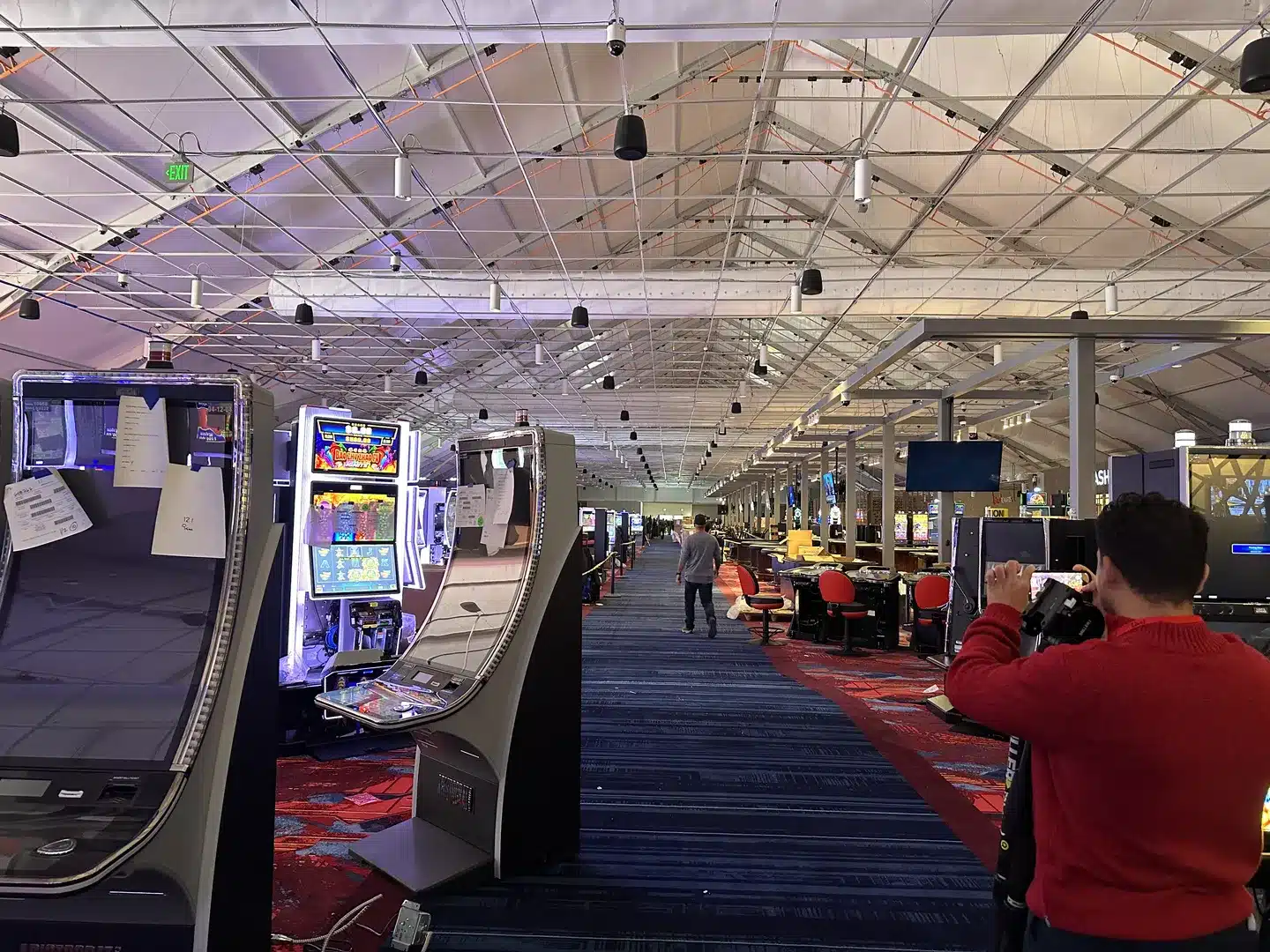

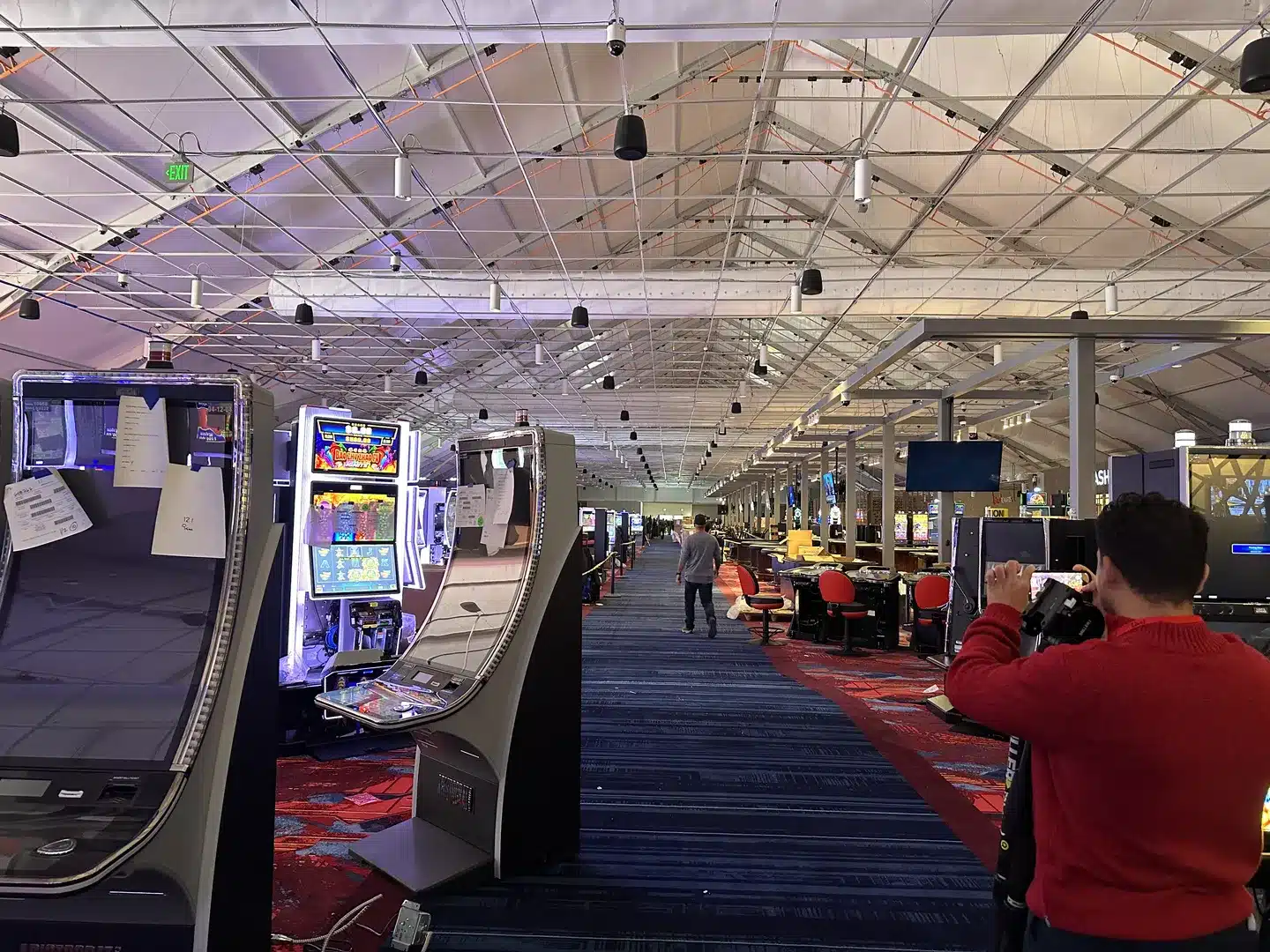

The financial results for the first quarter of 2022 have been announced for Churchill Downs Incorporated, which shows growth over the company’s previous year. Churchill Downs also completed the first two phases of the $90m expansion of Rivers Casino Des Plaines during the first quarter.

In terms of revenue, the company earned $364.1m in revenue through the first quarter versus Q1 of the previous year where Churchill Downs earned $324.3m. Net income was up to $42.1m, a $6m increase over 2021.

Another highlight of these results is the announcement of a definitive agreement to acquire substantially all of the assets of Peninsula Pacific Entertainment LLC (“P2E”) for total consideration of $2.485bn.

The company is also set to acquire Chasers Poker Room in Salem, New Hampshire, with plans to develop an expanded charitable gaming facility to accommodate historical racing machines, a total investment of up to $150m.

A few items impacted the comparability of the company’s first-quarter net income. Some of these items were a $6.3m after-tax increase in transaction, pre-opening and other expenses from the prior-year quarter related primarily to pre-opening expenses for Turfway Park and P2E transaction expenses.

Churchill Downs was able to offset some of their increases with a $4.5m after-tax benefit increase related to the equity portion of the non-cash change in the fair value of Rivers Des Plaines’ interest rate swaps.

Operating segments were also updated to include the results of the United Tote business in the TwinSpires segment. The company plans to integrate the United Tote offering with TwinSpires Horse Racing, to potentially increase business-to-business revenue opportunities.

An important note is that TwinSpires net revenue decreased by $3.6m from the prior year. The company believes this is due to a $6.9m decrease from horse racing that was partly offset by a $3.3m increase from sports and casino betting.

Churchill Downs also repurchased 116,863 shares of its common stock along with its publicly announced share repurchase program at a total cost of $25m in Q1 of 2022.

As of March 31, 2022, the company had approximately $420.6m repurchase authority remaining under this program.

Gaming America’s editorial staff provides authoritative coverage of iGaming, esports, and sports betting across the U.S. and Latin America in multiple language editions. Drawing on deep industry expertise, the team combines rigorous journalism with comprehensive testing of licensed operators, evaluating security, bonuses, markets, user experience,...

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.