Gaming & Leisure Properties Q3 2023 report: Heavy on the acquisitions

The company recorded a 462% increase in total operating expenses in Q3 2023.

Gaming & Leisure Properties has reported its third quarter 2023 financial results, ending September 30, showing an 8% rise in revenue to $359.6m.

The report also showed that adjusted EBITDA slightly increased to $327.1m, rising by 6%.

Of that revenue, the property that garnered the most was Pinnacle in its Amended Pinnacle Master Lease. This lease brought in $89.2m in rent during the three-month period.

Meanwhile, despite revenue increasing, income from operations fell 16% to $268.3m and net income also dropped 19% from $226.2m to $189.3m. Additionally, total operating expenses increased by a whopping 462% year-over-year.

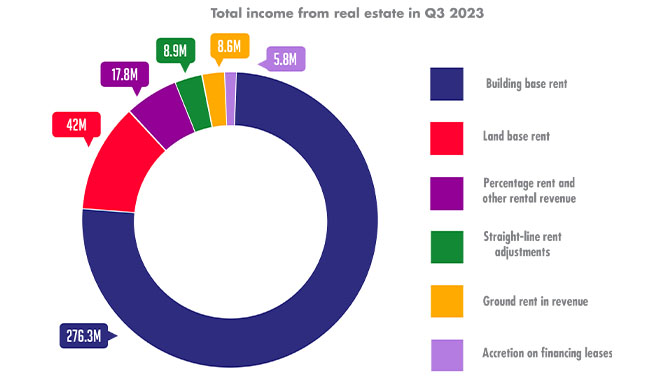

The pie chart shows the breakdown of total income generated from real estate in Q3 2023.

However, expenses would have increased by a large amount due to the company expanding its investment portfolio through multiple acquisitions. The company recently invested $32.7m on improvements at Casino Queen Marquette, but this also increased the annual rent on the Casino Queen Master Lease by $2.7m.

Gaming & Leisure Properties also entered into a 99-year ground lease with 815 Entertainment, with an annual rent of $8m, to acquire the land associated with the Hard Rock Casino development project in Rockford, IL for $100m.

Peter Carlino, Chairman and CEO of GLPI, commented, “The merits of our strategy to work with the industry’s leading operators and support their current and future initiatives, while expanding and diversifying our tenant roster in an accretive manner, was evident again in our record third-quarter results.”

He continued, “We remain excited about the agreement we entered into earlier this year with our tenant Bally’s and Major League Baseball’s Oakland Athletics, to develop an integrated casino within a new 30,000-seat Las Vegas stadium for the team at our 35-acre Tropicana site.

“GLPI intends to commit to up to $175m of funding for construction costs and may have the opportunity to provide additional construction financing under certain circumstances.”

Tags/Keywords

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.