Pollard Banknote Q2 2023 report: Net income triples to $7.5m

Pollard Banknote reported its Q2 2023 financial results, which showed its net income had tripled from $2.5m to $7.5m year-on-year.

The company also saw an increase in revenue from Q2 2022, rising 12% to $130.3m in Q2 2023. The statement clarified that, “This growth was due to increased sales of licensed products, digital and loyalty products, retail merchandising products and distribution services.”

EBITDA rose 49% to $23.5m and adjusted EBITDA also increased to $22.1m, up 17% from the second quarter of 2022.

However, despite the increases in EBITDA, revenue and net income, cost of sales increased 16% to $110.2m and gross profit dipped by 4% down to $20.1m.

The increase in cost of sales was, “Primarily the result of the accumulated impact of inflationary cost increases incurred throughout 2022 on raw materials and other manufacturing inputs. In addition, higher exchange rates on the US dollar also contributed to the increase in cost of sales as compared to 2022.”

This decrease in gross profit was the result of lower instant ticket sales. The company stated in the report how it continued to experience significantly higher manufacturing costs, caused by the impact of accumulated inflation on the costs of inputs to its instant ticket production.

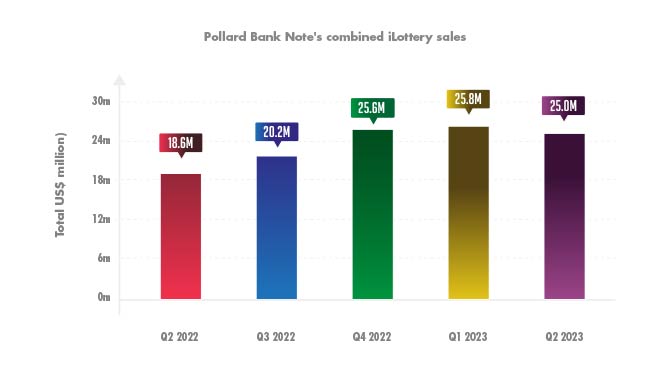

The graph shows the decrease in ticket sales which led to a dip in profit.

Pollard’s share of income from its 50% owned iLottery joint venture, NPi, increased to minus $9.2m in the second quarter of 2023 from minus $5.1m in the second quarter of 2022.

Doug Pollard, Co-CEO, commented, “Overall the strong demand experienced in all of our markets provides the foundation for continued growth throughout 2023 and beyond. In charitable gaming, eGaming systems and iLottery we achieved solid earnings, and remain confident these results will continue as we move through 2023.

“While high input costs remain in our instant ticket business, a better mix of higher margin work, and slowly increasing selling prices, generated improved results within this important business line.”

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.