Bragg Gaming reports Q1 net loss but key metrics see healthy rise

The supplier’s share price fell a little following its Q1 report, although CEO sees “significant underlying business momentum.”

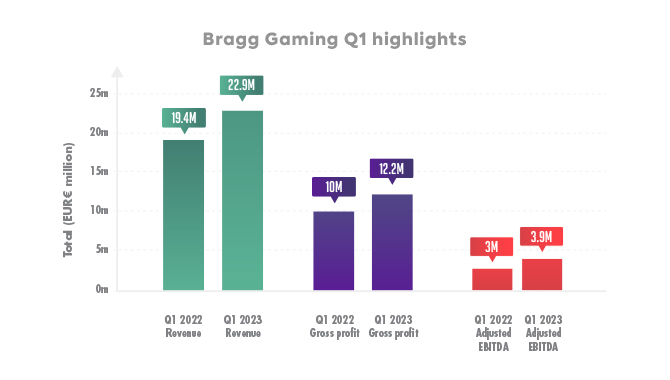

If it were not for a small net loss, Bragg Gaming Group’s Q1 2023 results might just be an accountant’s dream – with the supplier seeing double-digit growth across three key metrics.

Indeed, (as shown in the below graph) the company saw revenue rise 18.1% year-on-year to €22.9m (US$25.1m), its gross profit rise 22% to €12.2m and its adjusted EBITDA rise 28.1% to €3.9m.

However, Bragg did report a net loss of €0.5m, although this was down from €0.7m for the corresponding period.

Among the highlights referenced by the firm were new launches in New Jersey with operators DraftKings, Caesars, Resorts and Mohegan Sun, as well as a launch with Napoleon Sports and Casino in Belgium.

“Continued growth” in Switzerland was also backed up by market entrances in Mexico and Italy.

While Bragg’s share price is up since the start of May, its stock fell from a high of CAD$5.10 (US$4.81) to CA$4.67 upon the reporting of its results.

Other casino suppliers to have reported this week (although much different in size to Bragg), include Light & Wonder, whose Q1 revenue rose 17% to $670m.

IGT, meanwhile, saw revenue rise marginally from $1.05bn to $1.06bn. In terms of revenue growth, then, you could say there’s something to Bragg about with the supplier’s 18.1% rise…

Off the back of these results, Bragg has reiterated its full-year revenue and adjusted EBITDA guidance. Indeed, the supplier expects revenue to rise 10-15% to €93-97m for 2023, with adjusted EBITDA to rise 20-36% to €14.5-16.5m.

Bragg CEO Yaniv Sherman, an 888 Holdings veteran who was appointed Bragg’s CEO a little under a year ago, emphasized in-house technology and a variety of geographic regions.

Sherman said in Bragg’s Q1 report, “We continue to make consistent progress in scaling the distribution of our new in-house developed and exclusive third-party content, launching with an additional six operators in three North American markets and eight operators in five European markets to date in 2023; including our first entry with new proprietary content in Pennsylvania, Mexico, Italy and Belgium.

“Our start to 2023 demonstrates our ability to deliver strong near-term financial performance as we continue to successfully execute on our plan to drive consistent profitable revenue growth and increasing cash flow.

“As reflected by the midpoints of our 2023 full-year revenue and adjusted EBITDA growth targets of 12% and 28%, respectively, Bragg has significant underlying business momentum; we are confident we will continue to extend this momentum and create new near and long-term shareholder value.”

Players trust our reporting due to our commitment to unbiased and professional evaluations of the iGaming sector. We track hundreds of platforms and industry updates daily to ensure our news feed and leaderboards reflect the most recent market shifts. With nearly two decades of experience within iGaming, our team provides a wealth of expert knowledge. This long-standing expertise enables us to deliver thorough, reliable news and guidance to our readers.