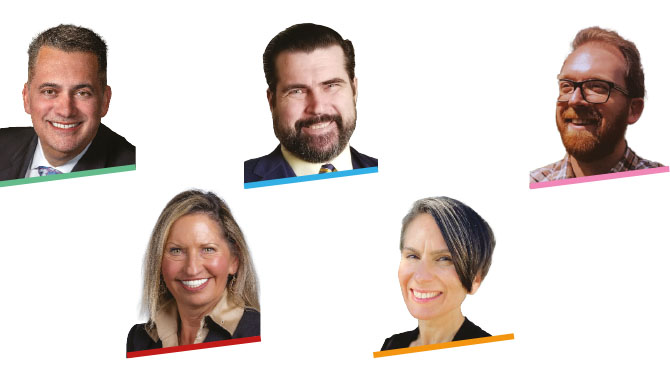

Anne Hay, SVP and Chief Marketing Officer at PayNearMe. With more than 15 years’ experience in the payments industry, Anne Hay is focused on covering the consumer and business trends iGaming and sports betting operators can use to inform and guide their payment strategies.

John Skorick, Founder of MIDs. John Skorick founded global fintech, MIDs, and payments consulting company SpurLead. John is a payments expert who started in the industry in 1997 at the first IPSP, DMR. In 2000, John left DMR to join payments startup, Jettis, and eventually took over all client services and business development. In 2009 John launched SpurLead, a payments and risk management company which he still oversees today. John acquired the domain mids.com to launch his global payments service. MIDs offers card acquiring and APM’s for iGaming companies globally.

Victor Newsom, SVP Product Management, Payment Solutions for Everi. Victor Newsom is a FinTech and Gaming veteran who has held leadership positions for a wide range of companies engaged in acquiring and issuing, processing, US and International operations, and card-based, virtual, cryptocurrency, and mobile payments, as well as DeFi. Victor has consulted with US law enforcement, worked on payments legislation, advised on central bank policy in emerging markets, and FinTech-related intellectual property.

Mandi Hart, Head of Product for Sightline Payments. With over 20 years’ experience in the gaming payments industry - including cash access, electronic check cashing, ATM, and kiosk solutions - Mandi Hart was instrumental in the company’s launches of cashless gaming technology at Resorts World Las Vegas and at Boyd Gaming properties in Nevada, Indiana, Ohio, and Pennsylvania. Her team also launched Sightline in sports betting states including Arizona and Wyoming. She has been on Sightline’s executive team for nearly a decade, serving as the Chief Client Solutions Officer before her current role. Prior to joining Sightline, she was the associate vice president of gaming business development at FIS.

Christopher Justice, CEO of Pavilion Payments. Christopher Justice’s 30-year career spans executive leadership roles with CenPOS, Ingenico, Merchant Link, First Data and Concord EFS. Christopher is an expert in the digital convergence of brick-and-mortar and e-commerce to deliver omnichannel consumer experiences. He joined Pavilion Payments, formerly Global Payments Gaming Solutions, in 2017 to lead its gaming division. Christopher has accelerated the organization’s mobile cashless funding, self-service, iGaming, security, and risk initiatives to help gaming operators modernize their cash access infrastructure, improve guest experience across resorts and capture new business. He is a member of the Board of Directors for the American Gaming Association and a member of iDEA.

What impacts customer loyalty from a payments perspective?

Anne Hay: We like to say that the entire player experience should be “pixel perfect.” At the first sign of a hiccup or glitch, players – especially new ones –can become leery of the entire process. Giving them that streamlined, seamless experience and offering the right mix of tender types is what will win over players and keep them coming back. Players want to have a choice of payment types they’re already using in day-to-day life, and when those specific payment types are already integrated into their betting app, players are more likely to come back and bet more often. According to research we did last year, 32% of players said they would make larger deposits more often if they had access to preferred payment types. Operators will see higher customer loyalty and higher player acquisition just by optimizing their cashier’s mix of tender types.

Christopher Justice: While many payments providers and gaming institutions offer great loyalty programs for their patrons, the real key to patron loyalty is an outstanding core payments experience. It does not matter if you have a slick-looking user interface or exciting offerings, if the payment experience is cumbersome or unwieldy. If your payment system is frustrating to use, then patrons will simply take their business elsewhere. For example, VIP Preferred allows patrons to utilize online bank credentials for faster, easier enrollment, and the nearly 3 million VIP Preferred users across the US can quickly and easily move their funds across participating institutions after a one-time enrollment.

Mandi Hart: Several industry studies have shown that fast cash outs is the top reason a customer chooses a sportsbook. We’ve done a great job as an industry in improving the deposit options – with debit card acceptance around 95% now, up from around 60% in 2018 when PASPA overturned. Until recently, cash outs have lagged behind with some operators taking a slow approach that could result in withdrawals taking up to five days. Sightline’s Play+ solution was designed for facilitating quick withdrawals, and you are finally seeing some additional innovation around real-time payments to enable those fast cash outs. As fast cash outs become standard operating procedure, you will see more innovation in leveraging payments as a loyalty tool. Just look at companies like Target, Walmart, and Starbucks. This strategy could have massive implications for gaming, as an omnichannel experience will allow patrons to move seamlessly from a table, to valet, to checkout and everything in between.

Victor Newsom: It is based on customer experience – convenience and perceived value. If I’m a customer, is there a value of me using loyalty points for spending and affinity, credit or debit, or some other debit product? Is there perceived value in going through a particular app so that I can get my comps, discounts and rewards? Did the customer have to go through a lot of hoops to enroll, download or set up that capability? As you remove friction on the front end, and as you increase the perceived value for better benefits in the back end, you have a compelling customer loyalty and engagement story. “Embedded payments” or “invisible payments,” not only remove friction from the enrollment process or opt-in process, but remove friction from the execution payments. Everi can help operators dynamically adapt to their needs, situation, and points of interaction – be the mechanics underneath the hood.

John Skorick: Offering the most common and popular payment methods in the customer’s respective country. The US is very simple. It’s almost all credit cards. But international operators need to offer the APMs (alternative payment methods) of choice in each country they wish to operate in, as customers have very specific preferences when it comes to ease of payment and payment methods. When in doubt, make it easy to pay.

What is the biggest gaming industry challenge for a payments company to keep up with?

Anne Hay: I think the biggest current challenge is navigating the rapidly changing landscape of iCasino and online sports betting. This includes emerging new audiences and territories, constant regulatory changes and frequent updates to payment technology. We always have to be aware of the shifting demographics of online players and their payment preferences. We need to innovate quickly to be able to cater to those preferences to capture that market for our operators. Then on the back end, we must remain compliant with all of the new states legalizing, so that our customers can go live quickly. It’s all about speed and adaptability right now, and we want to provide that for our partners and clients.

John Skorick: Regulations. Gaming demand is global and each country, or state/municipality, has different regulations and these regulations are constantly changing. We saw the fallout in India last year and many operators are still recovering from it. Proposed changes are happening in Europe, indecision in the US; it’s a constant challenge to keep up with.

Victor Newsom: There’s a convergence of challenges that span a few categories. We have the regulatory landscape that needs to continue to evolve in the face of emerging technologies, entrenched infrastructure and organizational mindset with operators, and converging customer journeys and use cases across channels and legal entities. Conversations around a “super app,” where you can game online, do sports wagering, pay for your hotel, attend an event, etc. are increasingly normalized. This leads to pressure to create a seamless experience. As a payments company, if you’re going to be part of the vision for what the industry could do, you have to work harder in the execution, the delivery process and in solving the technology and regulatory challenges. In the face of those challenges, Everi has continued to invest heavily in our people, licensing, and technologies, so that we can provide bridged omni-channel, multi-segment, tailored capabilities that encourage guests to have differentiated experiences.

Mandi Hart: The patchwork quilt of compliance and regulatory obligations, which are only growing more complex as online sports betting grows along with new jurisdictions. There is really no one-size-fits-all approach to payments from the mix of funding options to the licensing categories. Fortunately, Sightline has a tremendous team that understands the intersection of gaming and payments, allowing us to stay on top of these shifting trends and maintain a culture that understands these differences in order to deliver for our clients. This year we’ve worked with several regulatory bodies on their payments regulations to ensure that companies can simply remain compliant with them, like what we saw with proposals to prohibit joint bank accounts from being used for funding.

Christopher Justice: One of the most demanding aspects of our work has been keeping up with consumer expectations. Things like cashless transactions and e-commerce have dramatically shifted expectations, and we see it as our goal to bring that same payment experience that patrons have come to expect to the gaming industry. Pavilion’s e-check network, VIP Preferred, allows casino patrons to connect to more than 400 in-person and online gaming institutions, enabling the kind of seamless payments that patrons expect.

What are your thoughts on alternative payments, such as crypto?

Anne Hay: Macro conditions need to improve and regulations need to be ironed out before players and regulators are comfortable with crypto (specifically Bitcoin) being used in sports betting and iGaming. On the other hand, alternative payment methods like digital wallets are incredibly in-demand. The most preferred payment method from our research was PayPal, with 64% of players stating its importance. Venmo was also a preferred payment method for 48% of survey respondents. Customers want the frictionless payment experience that comes with digital wallet apps already downloaded on their devices—plus, these are apps that they already trust.

John Skorick: APMs specific to the customer country are critical for acceptance rates and customer satisfaction. I’m in favor of offering customers as many options as reasonably possible. I believe the majority of people buy crypto for investment, not spending, but with the ability for operators to accept and exchange for fiat in real-time, it is a solid and noteworthy option.

Victor Newsom: Whether it’s mainstream or alternative, you’re always trying to grapple with how easy it is to accept a payment, how trustworthy it is, and how real the payment is. In most cases, in regulated environments, who is providing the payment identity is important. With methods like crypto or real-time payments from the clearinghouse or fed, the idea of irrevocable transactions in real time are very attractive. They’re not necessarily technically easy, but the idea is that there’s really no (or low) risk of settlement associated with those transactions. The reality is you still have a lot of friction points in terms of identity. Everi has several products designed for the gaming sector that address regulatory, reputational, financial, settlement, and other risks while delivering convenience and value – but it is definitely not easy. It’s an industry challenge that means a tremendous amount of player, staff and regulator education requirements.

Mandi Hart: Customers should have the same payment options in gaming as they do in their daily lives. We at Sightline are so passionate about providing digital payments solutions at brick-and-mortar casinos. You’ve seen some of these alternative payment methods, Venmo and Zelle in particular, introduced in the cashier page for many sports betting operators. As for crypto, we’ve spent a lot of time on that opportunity, working with regulators to educate them on the technology. Until you have some federal guidelines surrounding the use of cryptocurrencies, it makes sense for the industry to take a slower approach to accepting those payments.

Christopher Justice: While alternative forms of payment are certainly interesting, there are not enough use cases for them to be viable for the gaming industry at this time. There are also regulatory implications of using cryptocurrencies in gaming, especially considering some of the recent controversies surrounding crypto. We will continue to keep a close eye on new alternative payment methods and develop ways to incorporate them into our solutions when they become commercially viable.

What technological advancements have recently changed how you do business?

Anne Hay: I think a lot of the interesting recent technology developments have been centered around AI and its possibilities. We expect AI and machine learning to have a profound impact on the payments industry, including faster fraud detection, streamlined Know Your Customer (KYC) processes, predictive payment outcomes, instant transaction processing, and fewer mistakes with reconciliation and settlement. We’ll definitely be keeping an eye on the advancements and assessing the opportunities. As far as the technology within our own platform, we take great care in protecting our operators against potential risk and fraud while providing players with a frictionless payments experience. We allow operators to fund player withdrawals with a single For Benefit Of account (FBO). Not only does this significantly reduce the complexity of offering many pay out options, but our backend processes enable operators to remain liquid and in control.

Christopher Justice: The way people move money has completely changed in the past couple of decades, and all of the recent innovations in payment technology have reshaped how customers want to spend their money on gaming. New technology like real-time payments has radically altered the payments industry at large, and their applications for the gaming industry could be equally revolutionary. New advancements like two-factor authentication also keep our clients and their patrons safer than ever.

Mandi Hart: The advancements around KYC orchestration have been massive. We talk a lot with regulators about the evolution surrounding digital identity verification, how it has improved over the past few years, and how new tools can help better protect players and operators alike. We have found that no one KYC solution can provide all the tools necessary – some are great at ID capture, others with biometrics and device fingerprinting, and others with their database checks. But as you begin to group these solutions together, you can really effectuate a more secure customer experience that reduces fraud and account takeover dramatically.

Victor Newsom: With new payments technology comes a change in actors, which is challenging the regulatory bar set for who can come into the space. It’s creating confusion as to who owns the guest experience and how we coordinate that to have the best loyalty and engagement. AI, facial recognition, biometrics, new uses of blockchain (not just for payments but for things that are like NFTs, real-world ownership or access controls) all have tremendous amount of promise for customer experiences, employee efficiency, and require advanced training to in more efficiently.

John Skorick: Craftly.ai has been a useful tool for content and advertising. But I still think the prevalence of video calls that came out of the pandemic have been incredibly important for our business. Our business is about relationships and trust. It’s important to be able to see each other, make eye contact and establish a trusting relationship. Not tech, but I’m very glad travel has opened back up for this reason, too.