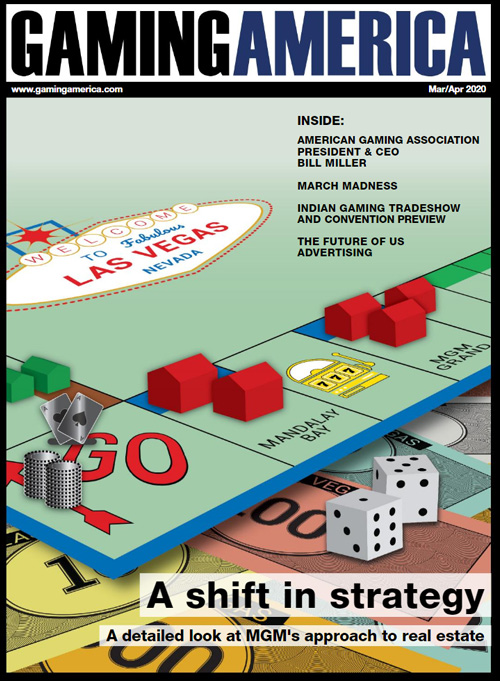

A major casino corporation without casinos or hotels? That may sound a bit oxymoronic, but in recent months, that has been the trend for one of the largest gaming companies in the world. In January, MGM Resorts announced the sale of the Mandalay Bay and MGM Grand to the Blackstone Group in a $2.5bn deal. Two months earlier, MGM and Blackstone reached a similar deal for the Bellagio in Las Vegas as part of a $4.25bn sale-leaseback transaction.

This isn’t exactly a complete casino purchase in the traditional sense and the details of the deal clarify the shift in strategy MGM has undergone in recent years. As part of the deal, the company’s real estate investment trust (REIT), MGM Growth Properties, enters into a joint venture with the Blackstone Group. MGM Growth will own 50.1% of the joint venture and Blackstone 49.9%.

As part of the deal, Blackstone also adds the real-estate assets of Mandalay Bay from MGM Growth Properties, and will lease both properties back to MGM Resorts at an initial annual rent of $292m. The moves are part of a shift in strategy to what’s called an “asset-light” MGM, where it moves towards simply functioning as a gaming and hotel operator. The company just no longer actually owns the building where eager gamblers book a suite and hit the slot machines and craps tables.

Outgoing Chairman and CEO Jim Murren said when the deal was announced: “These announcements represent a key milestone in executing the company's previously communicated asset-light strategy; one that enables a best-in-class balance sheet and strong free cash flow generation to provide MGM Resorts with meaningful strategic flexibility to create continued value for our shareholders.”

Shift in strategy

What is the point of this shift in business strategy? We are discussing this at a particularly interesting time, as it was announced in February Murren would be stepping down. He joined the company in 1998 and had been CEO since 2008. MGM's net revenue for Q4 2019 was $3.2bn, up 4% year-on-year, while adjusted EBITDAR descended 3% to $682m. Whatever the exact reasons behind Murren's departure, it will certainly lead to an adjustment period and change is clearly on the horizon for the operator as a whole.

Long-time Las Vegas business journalist David McKee says the new approach to property management allows MGM to reduce its top-heavy leverage and enables the company to harvest revenue streams from properties like Bellagio and MGM Grand, while paying relatively modest rent.

“Maintenance becomes the responsibility of the new owner,” McKee says. “The company is additionally incentivized to drive performance at the now-rented resorts.”

MGM becomes merely a tenant, operating its casino and hotel management business in a facility that it leases. For Blackstone, the deal offers a safer, more steady return than a traditional gaming investment.

“Gaming REITs are a safer play than the gaming group itself, which doesn't move predictably in the market,” McKee says. “Right now, gaming operator stocks are doing surprisingly well during the coronavirus outbreak, but the shutdown of the Macau casinos shows how vulnerable those stocks could be to volatile shifts in the economy. Already, stock analysts are writing off the first two, maybe three quarters of the year and putting their hopes on a fourth quarter 2020 recovery.”

A cash warchest

In general, Wall Street has been pleased with the new focus. As part of the announcement of the recent agreement, MGM made clear this won’t be the last sale and leaseback deal. The company listed possible deals down the line for its MGM Springfield property in Massachusetts and its 50% stake in CityCenter Las Vegas.

“Our corporate objective remains crystal clear," Murren said. "We will continue to monetize our owned real estate assets, which facilitates our strong focus on returning capital to our shareholders, while also retaining significant flexibility to pursue our visible growth initiatives, including Japan and sports betting.”

That “monetized” note is critical. MGM basically remains a casino company without losing control of its assets – not even the buildings it operates in. An agreement in rent has been reached and the company continues to function basically as it had before, but now with a cash infusion.

Mike Mixer is a Las Vegas-based Executive Managing Director of Colliers International, a global real-estate services and investment management company. He’s an expert in the resort and gaming market, and says that cash infusion allows a company to move beyond owning real estate.

“The primary advantage of this asset-light approach is to raise cheap capital without giving up operational control,” Mixer says. “This capital can be used for new growth initiatives or to pay down existing debt.”

While it is not part of the leaseback plan, MGM let go of Las Vegas’s Circus Circus to Treasure Island owner Phil Ruffin. The $825m deal also included the Slots-A-Fun Casino located next door and an adjacent 37 acres. Ruffin believed the properties would be part of a revival of the north end of the Strip.

“I’m very happy about it,” Ruffin told Vegas Inc. “This is going to make a lot of money. Where can you find 102 acres on the Strip? This has been a cash cow for a long time and it’s just going to become more and more valuable.”

However, MGM always viewed Circus Circus as a “non-core” asset and the sale added more cash to its warchest. A key part of these recent moves may be an overarching goal of winning a license to own a casino in Japan. Mixer believes that while the leaseback approach may be good for the business and stock, Japan is the ultimate goal.

The country recently legalized casinos to be operated as integrated resorts with hotels and conference facilities, with the goal of attracting more foreign tourists. MGM has plenty of experience in that arena, as anyone who’s visited Aria or Bellagio can attest. Mixer believes pursuing a casino license in Japan is the right move for MGM at this time and shows shrewdness among gaming company management.

“In particular to MGM’s strategy, it probably makes sense as they pursue a very costly, but likely lucrative, quest for a Japanese gaming license,” Mixer says. “The minimum cost to develop a project in Japan will be very high. [Leaseback agreements are] a relatively new strategy for the gaming industry, but not such a new strategy for the real-estate industry. I think it shows Las Vegas gaming companies have achieved a new level of sophisticated thinking.”

MGM even hinted at this approach as part of the announcement to sell MGM Grand and Mandalay Bay, with Murren noting the moves allow for it to return capital to shareholders but also retain “significant flexibility to pursue our visible growth initiatives, including Japan and sports betting.”

But are there any negatives to the company’s new leaseback and cash infusion approach? Are the actual casino facilities themselves a key part of a gaming company’s value? Could a disagreement among Blackstone and MGM derail the agreements at some point down the line?

“One challenge may be to devalue the overall company value as it removes hard assets from the balance sheet,” Mixer notes. “Another may be a longer term challenge to renew the leases with the new landlords. It is hard to predict what the market will be in 30 to 50 years.”

For the time being, sale and leaseback seem to be a trend in the industry, with Penn National Gaming and Caesars Entertainment making use of this approach to some degree as well. Many will be following the results of MGM’s more expansive approach.

Mixer adds: “I think other gaming companies are watching and exploring the strategy for their own companies.”

Sean Chaffin is a freelance writer in Crandall, Texas, and senior writer for Casino Player and Strictly Slots magazines. His work appears in numerous websites and publications. Follow him on Twitter @PokerTraditions or email him at [email protected] for story assignments.