Over the past three decades, the default paradigm for states considering enabling legislation has been to limit either the number of licenses available or the eligible geography. One must ask, though, how has this model ultimately performed? What factors should modern, emerging gaming jurisdictions consider as they develop their licensing framework?

Several states in the South and Midwest instituted “riverboat” casinos. While confining casinos to riverboats was initially a way of making gaming legislation politically palatable, over time riverboat requirements have been dropped. Most “riverboat” states have a fixed number of casino licenses. Mississippi has no restrictions on the number of licenses, but casinos are restricted to certain counties of the Gulf Coast and Mississippi River. Iowa has no set restriction by law; however, a rigorous approval process for new licenses and the objections of incumbents has kept the awarding of new licenses to only a handful over the past two decades.

Horseracing and parimutuel industries persuaded several states to allow casinos at racetracks and frontons (termed ‘racinos’). At first, these racinos were typically limited to slot machines, VLTs, or video poker. Over time, most racinos were permitted to operate table games. Nebraska has recently legalized casinos at racetracks; but having failed to limit development to existing racing licenses, the state is now contending with the question of whether to allow several new racing applications. Existing track operators are not overjoyed.

Similar to the riverboat fiction, two states took advantage of Wild West nostalgia to institute casino zones in historic mining towns. Colorado allows commercial casinos in Black Hawk, Central City and Cripple Creek, and South Dakota in Deadwood. There is no limit on the number of licenses.

Other states that have approved land-based casinos – such as Maryland, Massachusetts, Pennsylvania, Ohio and Virginia – have all limited the number of licenses available.

To this day, Nevada remains the only fully open-market commercial casino state. That said, when considering its charmed status, one must think about the advantages it had: The only casino jurisdiction in the country for decades, with the most populous state in the country right next door. Those conditions are not replicable, although Oklahoma – which is virtually an open-market tribal casino jurisdiction – has benefitted from sharing a border with Texas.

As new states discuss getting into gaming, will any break the mold and go the open-market route? There are reasons to think that will not be the case. The political advantages of limiting licenses are considerable: desire to control what is still perceived as a vice industry; desire to maximize state tax revenue and encourage blockbuster resorts; and incumbent lobbying efforts pushing for favored development (witness Virginia).

Moreover, the economic case for an open market is not necessarily overwhelming.

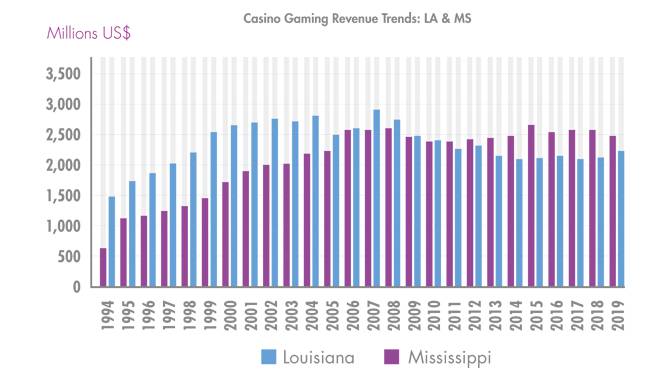

Twenty years ago, there was a lot of talk in Louisiana about how much smarter Mississippi was to let the market decide how many casinos to develop. At the time, gaming revenue in Mississippi considerably outstripped Louisiana; in 1999, it did so by as much as $1bn. However, starting in 2011, Louisiana began to pull ahead of Mississippi, and by 2015 it was bringing in $550m more than its regional neighbor. In terms of jobs, capital investment and gaming tax revenue, how do these two states and their different approaches stack up?

Confining our analysis to 2019 to avoid distortions caused by the pandemic: Mississippi reports a larger payroll and number of jobs, which makes sense since there are more casinos and hotel rooms to staff.

Limiting the number of licenses comes with tax advantages, allowing a state to impose a higher rate, since casinos face a less competitive and more stable environment. Louisiana riverboats have a 21.5% tax rate compared to the 8% facing Mississippi casinos.

Louisiana’s larger capital investment may seem counter-intuitive, as you might expect an open market to attract more development. However, limiting the number of licenses can facilitate a lower-risk investment environment and encourage resort development, as has been seen in modern gaming markets like Macau and Singapore. It should be noted that the reported Mississippi investment number includes divestment related to casino closures, most notably the largest casino in Tunica closing in 2014. Louisiana is not immune – the worst performing casino in the Shreveport-Bossier City market closed permanently after the pandemic – but the risk is lower.