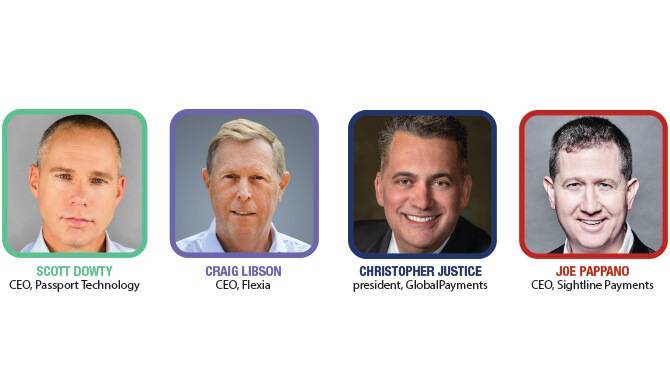

SCOTT DOWTY, CEO, Passport Technology. Scott Dowty has 25 years in payments and gaming experience and has had a strong presence in the expanding casino cash services industry. He co-founded Passport Technology in 2016 by introducing industry-first technology to targeted markets across the globe. Passport focuses on high barrier to entry markets as well as regulatory compliance, omni-commerce solutions and business performance. He also spent 10 years as director of CIBC Card Products, and CRO and EVP at CardConnect Inc.

CHRISTOPHER JUSTICE, President, GlobalPayments. Christopher Justice is a veteran leader in the world’s payment and commerce industry. He recently joined Global Payments to lead the company’s Gaming Solutions division, and his 25-plus-year career spans executive leadership roles at organizations such asCenPOS, Century Payments, Ingenico, Merchant Link and First Data.

CRAIG LIBSON, CEO, Flexia. Craig Libson has more than 20 years experience in digital payments and creating transformational, technology-driven products and services. He has a track record of driving next-gen product and market strategy, platform design and development, and creating strategic relationships most recently for Flexia’s multi-account, open/closed loop card/digital wallet products distributed through the gaming industry and other specialty platforms. He's led the creation and growth of several enterprises, including P2P and B2C payment platforms at Planet Payment and founding Cash2Go Inc., an international fintech and digital payments company.

JOE PAPPANO, CEO, Sightline Payments. Joe Pappano joined Sightline Payments as President of Americas after a nearly 30-year career at WorldPay, Inc. He also previously served on Sightline’s board of directors, while in his role of SVP and MD of WorldPay Gaming Solutions. He has deep knowledge of the payments industry, ranging from merchant acquiring, card-issuing & servicing, prepaid and rewards, mobile and alternative payments, agent bank and third-party processing with a focus on sports betting, casinos, lottery and igaming.

Cashless options have been around for a while, but can you describe your experience of how the pandemic has accelerated demand?

Scott Dowty: The pandemic has accelerated the chatter, not so much consumer demand for digital payment solutions. The term cashless is a misnomer, and the digital touchpoint will become increasingly important as online and brick-and-mortar experiences converge. The digital movement within casino payments began many years ago, and Passport continues to be the leader in omni-commerce points of interaction (POI), with the pandemic fueling new discussions. This acceleration is an opportunity to innovate, collaborate with customers, and further differentiate our position within the casino payments space.

Christopher Justice: Today’s patrons live in a digitally driven world where all matters of personal importance, both business and entertainment, are happening via mobile and online channels. Before the pandemic, operators were slowly adopting solutions to ensure their guests’ gaming experiences mirrored those happening in other areas of their lives. However, the global health crisis has revealed just how quickly the industry and its stakeholders must be able to evolve alongside the ever-changing gaming environment to meet consumer demands. The pandemic resulted in a steep decline in cash usage, exacerbating the need for cashless, contactless payment options to keep patrons and casino operators safe while adhering to social distancing guidelines.

Craig Libson: We launched our program in 2019 in Mexico, and at the time the focus was on cash management and security concerns of large amounts of cash in casinos. Since Covid, casinos began calling us to implement our program with a sense of urgency, citing the virus transmission issues of cash and the sanitary changes they needed to make at their cashier stations and back office. With our entry in the US this year, we’ve seen this to be a major concern of casinos, both from avoiding tactile transmission of the virus on the cash, to concerns about crowded cashier lines and social distancing practices.

Joe Pappano: The pandemic accelerated consumers’ transition to digital payments options as a whole. In-store mobile payments grew nearly 30% last year, with half of US smartphone users expected to use contactless payments options by 2025. Over 80% of consumers say they now view contactless as the cleaner way to pay. More than half of new contactless shoppers say they’ll continue to use contactless options once the pandemic is over. In the gaming industry, nearly 60% of casino visitors are less likely to use cash in their everyday lives due to the pandemic. Over 50% of gamblers indicate they’d be very likely to utilize a digital or contactless payment option when they gamble. These statistics show that cashless options are more important to casino visitors than ever.

How can cashless options help future-proof land-based operators as they get used to full capacity again?

Scott Dowty: Digital optionality on its own is not overly exciting, especially in today’s form. When seamless and efficient digital options reach full capacity and are fluidly available, land-based operators will realize increased efficiencies, improved regulatory compliance opportunities, and enhanced guest experiences. We’re taking a more expansive and dynamic path on digital, and the movement of funds will be muted by the importance and effectiveness of real-time loyalty offers and analytic levers. This is where land-based casinos will unlock the true value as cash slowly disappears from the casino floor.

Christopher Justice: Covid-19 has accelerated the demand for contactless payments as patrons gravitate toward safer, mobile-driven options that meet their needs and expectations. We fully expect these behaviors to remain after the pandemic subsides. As such, land-based operators will need to continue to provide and enhance these services. With digital payment options increasing in popularity, casino operators must successfully incorporate cashless payments that are system agnostic and don’t require an overhaul on casinos’ existing infrastructure to provide patrons with a truly seamless funding experience. Updating legacy technology with the latest gaming advancements is critical for casinos, especially as land-based and igaming operators develop omni-channel customer engagement strategies.

Craig Libson: Cashless is a term with many facets. Eliminating cash in gaming machines is the most basic, but it also encompasses the payouts to customers, and enables electronic deposits into the casino environment. All of these come with increased visibility into customer activity, and the ability to mine that data for both marketing and AML/KYC and other compliance needs. Going cashless positions the gaming operator to best prepare for the fintech expansion of what’s possible, which is our focus, and the increasing regulatory oversight from various agencies and jurisdictions like financial and gaming.

Joe Pappano: Digital payments powered by mobile devices empower consumers to do just about anything they need to. With payments modernization spanning every aspect of their lives, casino patrons will expect a modern gaming experience to include seamlessly linked slots, table games, cage operations and loyalty. And since the pandemic accelerated society’s shift to digital payments overall, more than half of new contactless shoppers say they’ll continue to use cashless options once this pandemic is over. And even looking toward the future, younger consumers are acclimated to digital payments being a part of their day-to-day lives. Casinos are one of the last cash-based industries in the world, and payments modernization is critical for the industry’s continued growth.

Innovation is only as sucessful as its uptake with consumers. What is the adoption rate among those used to cash, unsure of adequate security, and untrusting of new technology? How do you assure people that cashless is a better way forward?

Scott Dowty: This is a complex and challenging task and only complicated by the fact that gaming is governed by much more than technology. Jurisdictional regimes, gaming regulations, responsible gambling, cultural beliefs and individual superstitions all play a part in adoption and interest in moving away from cash. People will be assured by reputable providers such as Passport, who lean on security and compliance as core tenants and will adopt solutions where the experience is fluid, familiar and timely. People will be influenced and persuaded to adopt through loyalty, a fully connected experience, convenience and ease of use.

Christopher Justice: Consumers increasingly prefer to pay with cards and electronic-based forms of payment, both in physical and digital environments. In fact, only four out of 10 consumers carry cash regularly, making cash access at the casino an increasingly frustrating point of friction. As consumers shift to a cashless society, alternatives to traditional forms of payment help operators conveniently meet the demands, regardless of their payment method. Cashless solutions have the potential to deliver hardened bank-grade security to casinos’ complex gaming environments while equipping guests with a seamless payment experience from funding through cash-out. Plus, cashless solutions reinforce the latest responsible gaming initiatives to ensure the player experience remains safe, without creating issues for operators or guests.

Craig Libson: We promote adoption through the non-transactional benefits of the program, such as our tie-in to casino loyalty programs for spend on our card’s Mastercard account outside of the casino, and special rewards provided in-casino only to Flexia cardholders. Covid has provided an unexpected boon to adoption, as customers increasingly migrate their day-to-day consumer transactions to plastic (voluntarily or by merchant mandate), so cashless in the casino seems more natural. Plus, the underbanked population is recognizing the need to be part of the electronic payment world, which we facilitate by enabling a customer to obtain a multi-account Flexia card in minutes at the casino counter.

Joe Pappano: Cash is still an option for those who prefer it, but cashless options are becoming increasingly common. Cash is expensive for casinos to count, store, acquire and transport, and cashless ecosystems significantly reduce this overhead. Mobile wallets allow patrons to skip lines at ATMs and cages, saving them valuable time. Digital payments also equip customers with robust tools to govern their own gaming behavior and give casinos increased visibility to ensure that guests are gaming responsibly. They enable casinos to revolutionize and personalize loyalty rewards by better understanding consumer behavior. Digital payments also create a paper trail, giving law enforcement new abilities to trace and prevent financial crimes like money laundering. The benefits of digital payments to all parties involved will help head transition to them.

How has cashless helped bridge the divide between land-based and digital operators? Is there a greater sense of collaboration within the industry?

Scott Dowty: Digital payments have certainly promoted collaboration between players in the space and will continue as viable, performance-driven solutions take shape. The casino payments space is highly regulated, complex and quickly evolving, and behavior-driven solutions will win the day, which will only be found through collaboration. We understand strategic partners will play an important role in our ability to execute and provide our casino customers and their patrons a digital experience that ticks all the boxes. A fully integrated digital experience through the resort, land-based casinos, online and within asset portfolios is the holy grail, and it will take an industry working together to achieve such a monumental solution effectively.

Christopher Justice: Igaming experienced rapid growth since the Covid-19 outbreak, and operators are increasingly understanding the need to have hybrid approaches to gaming in a post-pandemic world. Similar to cashless gaming on the casino floor, the pandemic increased the demand for online and mobile gaming methods. Operators can leverage this demand to their advantage by implementing igaming solutions that utilize a multi-channel approach to connect online and brick-and-mortar experiences. The blending of digital and physical elements enhances the gaming experience, making it a viable area for operators to explore in states where it’s legal. Brick-and-mortar gaming revenues have been shown to grow alongside igaming revenues when it is introduced, so creating a multi-channel experience represents a great way to grow loyalty across both and increase wallet share.

Craig Libson: Probably the most A-hah! moments we see are when gaming operators recognize what we can accomplish for them. Not only are the land-based and online platforms different, but we've seen a great divide internally with operators between the casino and online divisions, and the issues they prioritize. By sharing creative solutions enabled by cashless, they see that the benefits go beyond funding and payout to include onboarding efficiencies, cross-pollination of platform data, coordinated marketing and benefit programs, and customer communications. We recently had one global gaming company executive tell us that we are providing the key to getting the online and land-based divisions of the company to speak to each other.

Joe Pappano: Cashless has given operators new opportunities to integrate their online offerings with their brick-and-mortar business. As online casino becomes an increasingly important part of operators’ business, it’s essential they tie in consumers’ online gaming activities with their in-person gaming experience. Payments are key to doing that. In the ideal scenario, consumers will be able to use the same digital wallet for online casino, slots, table games and sports betting, and then use some of their winnings to buy a round of drinks for friends, pay for dinner or purchase something special at a retail outlet. This lends itself to increased collaboration between different gaming verticals, from casino management systems to retail to hospitality.