Would you say the pandemic and online acceleration have led to a greater appetite for more states to legalize sports betting?

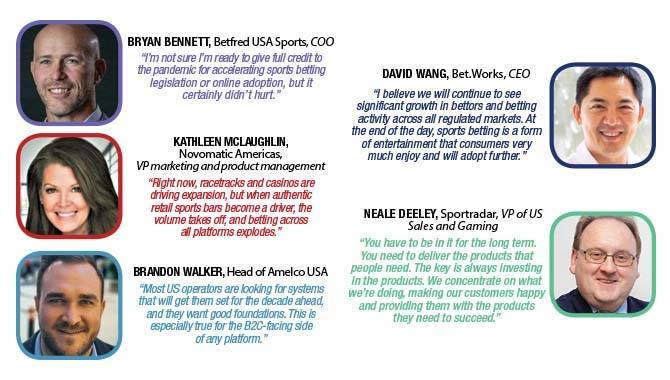

DAVID WANG:

As difficult and unfortunate as the pandemic has been for everyone, it’s probably fair to say that the growth of online sports betting has played a factor in how states are viewing the legalization of sports betting. In addition, as more states have successfully approved and launched sports betting, I believe this fosters a better understanding of the market and momentum for greater adoption.

KATHLEEN MCLAUGHLIN:

Absolutely. Budget shortfalls have a lot of legislation considering sports betting. The reality is that the economic fallout has sped up momentum. For example, New York has a multi-million-dollar projected budget shortfall, which caused the Governor to reconsider his position and put online sports betting back on the table. The pandemic has generated renewed interest in states like California and numerous others to legalize sports betting to solve their budget deficits. We don’t see demand slowing down, and there is an integral link between online and retail. Much work continues behind the scenes, even with the pandemic, to make sure that sports betting expansions have the opportunity to move forward quickly as North America opens again. We believe that there is an underlying demand for retail that will rebound sooner than later. More than ever, people need to share experiences and reconnect, so retail and online will continue to reinvent themselves as post-pandemic entertainment experiences.

BRYAN BENNETT:

I’m not sure I’m ready to give full credit to the pandemic for accelerating sports betting legislation or online adoption, but it certainly didn’t hurt. The position many states now find themselves in with regards to budgets and tax revenue has encouraged them to put all options on the table including gaming adoption and expansion. In general, there was already momentum for sports betting nationwide; I’m sure the current budget shortfalls have had an impact on timing.

NEALE DEELEY:

Yes, but there always was an appetite for the further legalization of sports betting. Those reasons have only been accelerated by the Covid-19 pandemic and its associated lockdowns, and the effect that has had on the gaming sector. This is particularly important when you consider the effect of the various lockdowns on land-based gaming in the US. I think this has had the most effect when it comes to the strength of the opposition to online gaming and betting.The volume of the opposition from these sources has decreased. There is now certainly less opposition and their voices have somewhat faded away. This is largely because of the evident tax and revenue benefits that sports betting and online gaming states have enjoyed, compared to states where land-based gaming has been all but shuttered for much of the past year. The arguments against online sports betting have been harder to maintain during the past year while those in favor have been emboldened.

BRANDON WALKER:

Yes, with absolute certainty. States across the nation are getting switched on to the fact that there is a real windfall available in terms of boosting income for the state, as well as providing a wealth of entertainment. I would also say that as online gaming and sports betting become more mature both in terms of markets and mainstream popularity, it immediately becomes less of a taboo subject. We’re now almost a full year into sports betting being truly commonplace across the states, with betting lines now becoming a normal part of a conversation surrounding a sporting event, and it offers a whole new dimension when it comes to stats-based action. We can see this with the Super Bowl, which smashed all expectations, and it’s only going to get bigger. Regulators are realising this and improving their processes, making it easier for bookmakers to onboard players and take bets.

As states continue to legalize sports betting, what is the scope for increased competition for the likes of yourself and your competitors?

DAVID WANG:

Given the significant market opportunity that legalized sports betting represents, there have been a number of companies looking to position themselves for entry and growth. We are seeing that in companies across a broad range of sectors from gaming to technology, to media and beyond. For us at Bet.Works, and soon to be part of Bally’s Interactive, we are excited about our ability to capitalize on the market given the powerful collection of assets. Specifically there is the Bally’s brand, market access footprint, and database; the partnership with Sinclair and the Bally Sports regional sports networks; and, of course, our technology platform and product offerings that are further augmented by the recently announced acquisitions of Monkey Knife Fight, the third-largest DFS operator in North America, and SportCaller, a leading free-to-play content developer. Therefore we expect in time to be a leading operator within the regulated sports betting market and capture a significant market share in all of the jurisdictions where we operate.

KATHLEEN MCLAUGHLIN:

Each time a new state passes a bill to make gambling on sports legal, or changes the law to allow more competition among betting platforms, it’s good for Novomatic Americas. It extends our self-service betting terminal reach. We’re at ground zero in a land grab between market-leading competitors who are in aggressive growth modes, and, fortunately, we work with everyone from BetRivers, Penn Gaming, DraftKings to most recently Playtech. Scores of competitors are attempting to enter the market, and our vision for the future is to be the preferred retail solution provider and ultimately provide in-demand wagering hardware working with premium software providers. Right now, racetracks and casinos are driving expansion, but when authentic retail sports bars become a driver, the volume takes off, and betting across all platforms explodes.

BRYAN BENNETT:

Every state in the US is going to be acompetitive challenge for every company in the space, at least at the onset of legalization. Just look at Colorado where we’re not even a year into sports betting and we have at least 20 companies vying for market share in a state of six million people. As a result, any company that enters the US market is going to need to be prepared to spend marketing dollars or bring some creative solution to securing customers. It will not be for the faint of heart and it will probably be a few years before the dust settles.

NEALE DEELEY:

The market has always been competitive. Anybody who knows the scale of the US market has been targeting it, so competition here is already pretty fierce and, in my opinion, it’s been like this from day one. It was never not competitive and nothing about the experiences from the past year has changed that. The recipe for winning hasn’t changed either; you have to be in-country and in it for the long term. That is the only way you can win out.

BRANDON WALKER:

There’s plenty of opportunity out there as more states legalize and regulate; we’re going to see plenty of local players getting in on the action alongside international suppliers. And as time goes on, we’re going to see books looking to differentiate themselves in the marketplace, and it will be interesting to see. When it comes to dominating market share, it all comes down to the quality of the product, and we’re not seeing a race among suppliers to underbid with good reason. Most US operators are looking for systems that will get them set for the decade ahead, and they want good foundations. This is especially true for the B2C-facing side of any platform. And as punters become savvier, they will quickly understand what a quality product is over an average counterpart. Looking at the bigger picture, we also need to remember that it’s not always about the product alone, and US clients shouldn’t be pigeonholed. From Amelco’s side, we offer a best of breed solution as well as the added value partnerships with the likes of Swish, Genius, Sportradar and Gamesys, which supply a raft of add-ons for data, prop bets and casino.

How can your respective company compete with others for greater market share and how do you think you can make your mark on the us sports betting market?

BRYAN BENNETT:

This is the key challenge that everyone in the space is trying to answer. For Betfred Sports, the answer is to stay true to our brand heritage from the UK while providing superior value to bettors. While marketing dollars are required, we believe that signing the right partnerships, whether with casinos, media partners or sports teams, can yield a competitive advantage. And we will adjust our approach on a state-by-state basis, which we believe is key to our success. In Colorado, for example, we have settled on a local approach. We’ve signed a sponsorship agreement with the Denver Broncos and a marketing agreement with Rod Smith, the greatest wide receiver in Broncos history, to be our brand ambassador. Additionally, we’ve invested heavily in a partnership with KOA, a local radio station, and worked with some local charities. That local approach has worked for us there, but that may not be the right recipe in other states.

KATHLEEN MCLAUGHLIN:

The answer is experience and speed to market. Sports betting is not a quick and easy business to enter. We are fortunate to have incredible resources that are dedicated to spending on development, marketing, technology and legal to help navigate our expansion from state to state. We have worked hard in a short period to become the market-leading provider of kiosks. Each state is slightly different and we have an internal hardware infrastructure that allows our hardware to integrate well with almost all software providers. We respond quickly and efficiently to every changing market condition, and when our customers ask for a quick turn around and a great product, we deliver. As an example of how quickly we adapt, our latest 2D scanner capability takes speed of betting to a new level. Build your bet ticket on the platform app, take your mobile device with QR code to a kiosk, which is virtually touchless betting since the ticket automatically appears on kiosk, confirm your bets and you’re done. Our increased bet speed and safety is an advantage, especially on busy sports days.

DAVID WANG:

I think that the key to our success will come down to the product in creating an experience that is fun and engaging. So this means continued innovation to our existing core offerings, but even more significantly, this will mean integration with Sinclair and Bally Sports RSNs on the media side, and with Monkey Knife Fight and SportCaller on the DFS and free-to-play side. Our vision is to be an omni-channel gaming company, and those integrations will be critical in differentiating our offerings and establishing ourselves as a leader within the space.

NEALE DEELEY:

As I said, you have to be in it for the long term. You need to deliver the products that people need. The key is always investing in the products. We concentrate on what we’re doing, making our customers happy and providing them with the products they need to succeed. As long as we delight the customers, we’re confident that we’ll maintain and grow market share. We very much see the US opportunity as one where we’re partners with our customers, and the eventual winners here are the consumers.

BRANDON WALKER:

Again, it’s all about quality. This is where it starts and stops for us. As we’ve seen with other suppliers who have rushed in too fast, without fully understanding the operating conditions they’re dealing with, as well as betting behaviour and patterns, it can be a difficult market. We’ve got one of the best trading teams out there and are feed and partner agnostic, to deliver one of the best solutions. We’ve taken our time to analyze the market, understand it and build the best product with the best features, and we’re delighted with how far we’ve come. Taking a look at the Tennessee roster for selected suppliers, with our name alongside the likes of DraftKings and BetMGM via our Action 24/7 partnership, it’s a testament to our status in the US as one of the leading platforms, and we’re very proud.

What are the biggest trends we can expect to see from the sports betting industry? are there any upcoming states you're particularly looking at to become legal?

BRYAN BENNETT:

I don’t know that there will be any sort of new product trends coming to the US marketplace, but I do think the big story will be the large number of new states that launch this year. Virginia has already launched, and we’re also seeing positive momentum from Louisiana, South Dakota, Washington and perhaps even some new opportunities with Oregon and Texas. From a our perspective, we’ve previously announced our partnership with Mohegan Casino at Virgin Hotels Las Vegas, and that sportsbook will launch in 2021 once we’ve completed our work with the Nevada Gaming Control Board. We’ve also secured partnerships in Louisiana and Washington, which we’ll announce as we get more clarity on the regulatory situation in those states. So 2021 is going to be a huge year for us as we scale our current states and launch new ones.

KATHLEEN MCLAUGHLIN:

A few significant trends grew through the lockdown and are gaining traction. Fierce competition in the betting mobile app space is already crowded and becoming more intense, and as a result more live stream events will be offered. Competitors are using the live stream as a value add and an enticement for in-betting where permitted. Because of improved apps, late betting is key so that bettors can understand player or team health and availability in any given situation. It becomes easier to hold off as long as you can to place your bet. Finally, the best trend is the incredible availability of data for bettors and operators. Interpreting and using data to wager has improved exponentially. We are currently looking at every state that even looks like it is thinking about sports betting and are active in quite a few areas.

NEALE DEELEY:

There are exciting developments across many and various states that might either be legislating or opening up sports betting this year, plus on a product level, there’s the continued trend for in-play to grow. On the regulatory front, the murmurings around possible moves in the big four states are very positive, particularly in terms of mobile betting. In fact, that goes for most of the other states where initiatives are ongoing; the arguments in favor of opening up to mobile seem to be gaining favor across the board. This has to be seen as a positive for the sector and its development.

DAVID WANG:

I believe we will continue to see significant growth in bettors and betting activity across all regulated markets. At the end of the day, sports betting is a form of entertainment that consumers very much enjoy and will adopt further. There are a number of states where I’m optimistic we will see good progress in over the next 12 to 18 months, including Virginia, Ohio and Arizona, but every situation is fluid and there is work still to be done.

BRANDON WALKER:

Player props and stats are clearly the biggest growth areas for not just us, but also the industry as a whole. In the US, players are king, and being able to look at a stat line to try and find an edge on Steph Curry's three-point shots or Tom Brady's passing yards is a huge hook for punters. Niche sports are also a huge opportunity. NASCAR, college sports, UFC, golf and the Olympics will all gain plenty of interest this year, especially given the sheer number of categories US athletes dominate. Soccer is another big growth area, especially given the emergence of the Hispanic demographic in terms of betting. Horse racing is another vertical we’ve got our eye on. Fixed odds and tote betting offers plenty of scope for further expansion. I definitely believe the swift resolution of a horse race offers a completely different experience to a three-hour football game. After all, it’s all about instant entertainment.